Way back at the beginning, we blogged about the different kinds of flood. Maybe we should have included winter flooding from ice floes. Granted, it is a variety of fluvial (or riverine) flooding, but there are some unique characteristics to this type of flooding.

Last week, we explored how likely it is for insurance to be disrupted in 2018. It sounded rather unlikely.

Topics: Flood Insurance, Property Insurance, Flood News

Here we are in the dog days of summer, and because we can’t just write about wildfires every week it’s time for the Top 3 posts from Q2.

Topics: Natural Hazard Risk, Flood Insurance, Flood Risk, Flood News

New York has a new museum, or at least a new location for an institution. In 2016 the Whitney Museum of American Art moved down to the waterfront at the southern end of the High Line, with the new building (designed by Renzo Piano) widely lauded as a success. While most reviews and articles on the new Whitney focus on the architectural highlights and nuances, such as the design’s openness creating a seamless integration with the vibrant surrounding streets, the Atlantic published an article on its flood defenses. To wit: … the new Whitney’s most intriguing feature might be one that’s gone largely unnoticed: its custom flood-mitigation system, which was designed halfway through the museum’s construction, in the aftermath of 2012’s Hurricane Sandy, when more than five million gallons of water flooded the site.

Topics: Flood Risk, Private Flood, Flood News

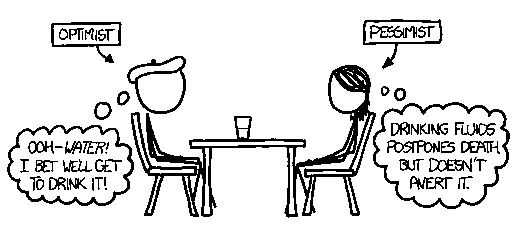

Flood Insurers 2017: Glass half empty or half full?

Posted by Bill Raymor on Dec 14, 2016 9:26:56 AM

I get to work with some very talented folks at Intermap Technologies on a Natural Catastrophe Risk product called InsitePro. It is a tool designed for underwriters that analyzes and scores location-based risk. With H.R.2901 - Flood Insurance Market Parity and Modernization Act - making its way through Congress, thus enabling the Private Flood Insurance Market to close the Insurance Protection Gap as well as alleviate some of the NFIP’s $25B debt load, we are seeing a growing interest in InsitePro. One reason for that interest is our U.S. flood model called FloodScope. It is derived from a seamless proprietary 5m elevation dataset and is both distinctly different from and more useful than FEMA’s FIRMs for evaluating flood risk at a single location. Here is the difference…

The problems facing private insurers are both many and well documented.

In a BenefitsPro article titled Insurers still coming up short on digitalization written by Jack Craver in November of this year, he stated, “One of the most common barriers to truly transforming the business via digital solutions is the persistence of legacy systems that employees continue to rely on instead of newer approaches. In fact, 80 percent say that while the organization is currently undergoing upgrades to their system, the implementation is hampered by fragmented leadership that conflicts about replacing legacy systems for policy administration and agency management.” And, in a PropertyCasualty360 article from the same month titled Top 7 Insurance industry concerns for 2017, author Jamie Yoder states his first two concerns as:

- The rise of insurance technology

There are several business challenges that established insurers are facing as they try to meet new customer needs while improving core insurance functions. A specific focus on insurance technology, or “InsurTech,” has emerged to help insurers solve these challenges. - Artificial intelligence

The initial impact of artificial intelligence (AI) primarily relates to improving efficiencies and automating existing customer-facing, underwriting and claims processes. Over time, its impact will be more profound; it will identify, assess and underwrite emerging risks and identify new revenue sources…

Topics: Flood Insurance, Private Flood, Flood News