Insurance, Financial Services and Real Estate

Intermap’s European Insurance division is a long-time supplier of natural hazard maps and analytical tools throughout Central and Eastern Europe, the United States and Southeast Asia.

In Europe, Intermap provides its software, data and analytical solutions for quantification of natural hazards and climate resilience to major insurance players and is growing the business with financial services and real estate market players.

Intermap’s solutions integrate data and analytics from national governmental geodetic, hydrologic, meteorologic, geologic, environmental and agricultural institutions as well as private players in real estate property valuations and other fields to enhance the natural hazards and climate resilience quantification throughout the policy life cycle, from underwriting to reinsurance to claims adjustment.

In 2023, Intermap announced a strategic partnership with Twinn by Royal HaskoningDHV. This partnership offers comprehensive data on natural hazards, including flood and climate resilience, and other perils, such as windstorms, lightning, hail, wildfires, landslides and earthquakes. It also includes forward-looking hazard maps for estimating possible future risks arising from climate change, such as drought, heat, cold, precipitation stress, and weather suitable for spontaneous fire formation. The collaboration provides the insurance market with the most comprehensive, advanced natural hazard data that enables underwriters, risk engineers, reinsurance specialists, claim adjusters, actuaries, methodologists and other professionals to have the insight and knowledge to make data-driven decisions to manage the evolving challenges associated with natural hazards and climate change.

We offer subscriptions for multiple hazard maps, such as flood and other acute meteorological perils, as well as chronic climatic and geophysical perils. We also provide subscriptions for climate change-based hazard maps for flood and other chronic or acute perils.

We also offer (re)insurance analytics and services, such as bulk geocoding and address/parcel standardization, floaters redistribution, accumulation, choropleth maps (cartograms), portfolio analysis, AAL calculation, elevation profile analysis, claim adjustment analytics and natural catastrophe and probable maximum loss modeling.

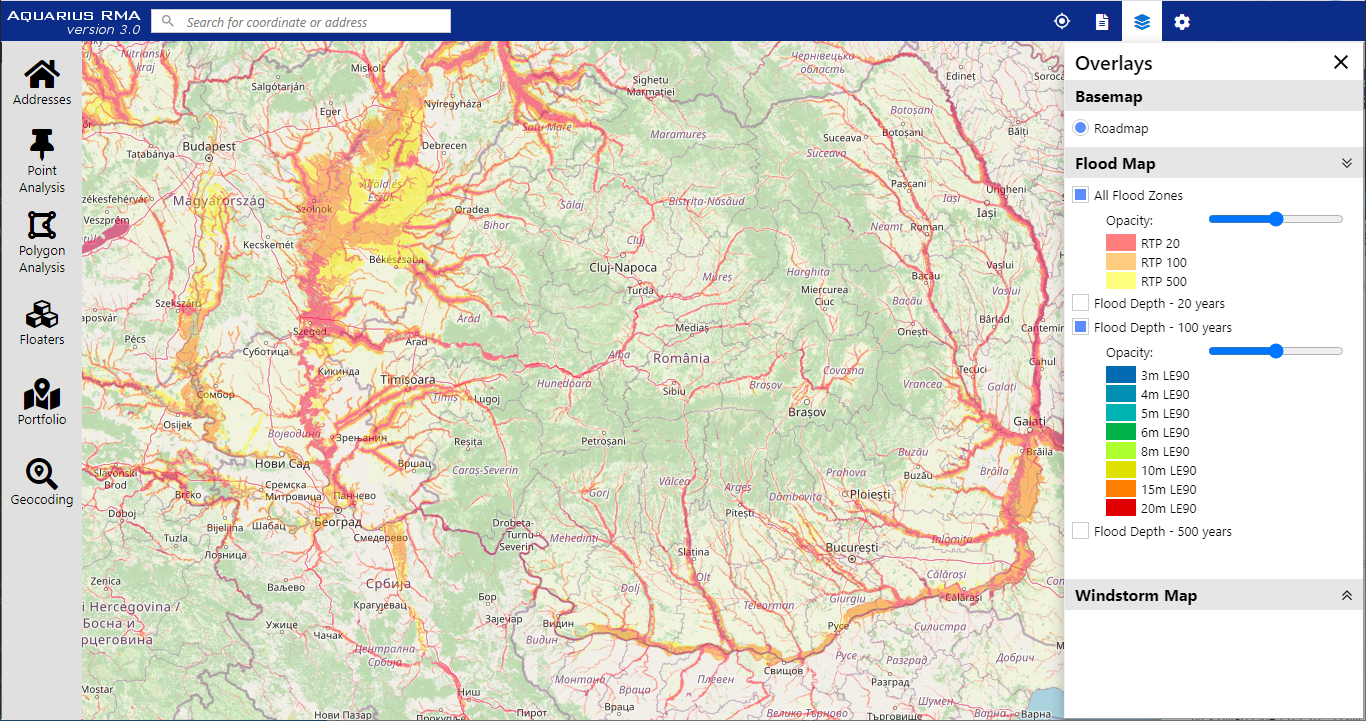

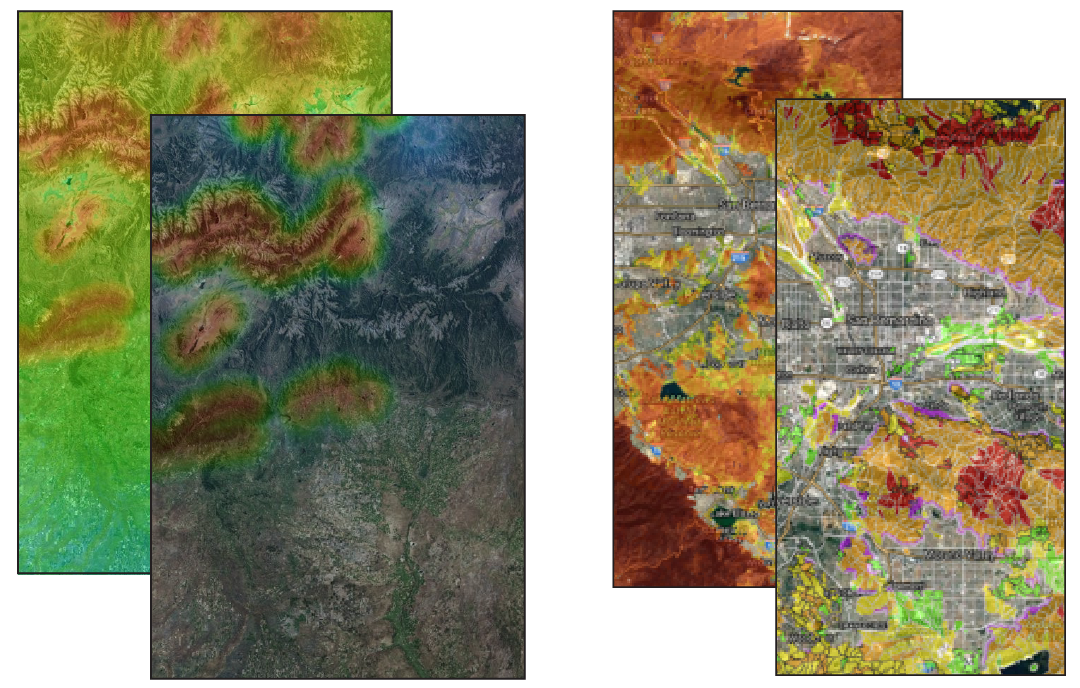

Natural hazard maps: River Flood Depth (left), N-years Flood Extents (middle), Flood Insurance Rating Zones (right)

Aquarius RMA is our SW, Analytical and Data solution for quantification of Natural Hazards and Climate Change Risks. It is available on a subscription basis operated by Intermap within a geographically distributed cloud environment.

Hazard maps: Earthquake (left), Landslide (middle), Hail (right)

Hazard maps: Windstorm (top left), Drought (top right), Lightning (bottom left), Wildfire (bottom right)

Analytics: Accumulation (top left), Area/Polygon Analysis (top right), Terrain Profile (bottom left), Portfolio Assessment (bottom right)

RMA Web Services allow client workflows, such as policy management, underwriting, claim management systems or online insurance applications, to query risk information for a particular address or geo-coordinate location. RMA Web Services is available via API for integration with third-party solutions, with a predefined number of calls per month.

Flood analysis

CAT / PML Modeling. Stochastic modeling of possible maximum loss (PML) for flood using limits, deductibles, coinsurance, and multi-locations as well as custom vulnerability functions.

Manual Geocoding & Address / Parcel Standardization. Bulk geocoding of addresses or parcel numbers and their risk evaluation. This includes standardization and correction of typos, mistyped street names or postal codes, abbreviations and missing characters.

Flood Footprint Mapping. Custom mapping of flooded areas using airborne or UAV technologies.

General Insurance Consulting. Cost-benefit analysis, customer seminars and trainings, portfolio risk analysis, custom risk mapping, application support during catastrophic events, UAV-based risk and claim assessment.

Data Updates. Recurring or one-time updates of hazard map layers, address or parcel databases, and background maps.

Our Geocoding Solutions are subscription-based services for insurers, reinsurance brokers and reinsurers.

|

Example of a flood hazard map in Romania. Green dots represent correct location after batch geocoding process, orange dots represent original incorrect location. It is not uncommon for a property to be incorrectly categorized as outside a flood zone when it is actually located inside one, or vice versa. |

|

Batch Assessment. Large portfolios are assessed for the purpose of reinsurance renewal, claim management or underwriting of portfolios from brokers or multi-locations. Automatic Bulk Geocoding & Risk Assessment. Automatically cleans data in batch and assigns the correct address, coordinates, and hazard zones based on Intermap’s or third party hazard maps. Polygon-Based (area or footprint) Risk Assessment. Risk evaluation for larger sites such as industrial areas, transport infrastructure, agricultural parcels or custom defined shapes. |

Our data and analytics are available to our partners in financial services and real estate for use in property valuation applications. This includes risk information on flood, other acute or chronic meteorological perils, geophysical perils, as well as climate change-based forward looking risk information and multi-risk assessment.

Earthquake map (left) and wildfire map (right)

Supplier – These partners supply data that is integrated into our solutions and delivered to customers in the insurance, financial services and real estate markets.

Value-Added Resellers – These partners combine Intermap data and analytics services with their solutions to address insurance, financial services, and real estate market specifics and client requirements.

Associations – These partners secure the interests of insurance, financial services, and real estate companies and help establish our position in the markets.