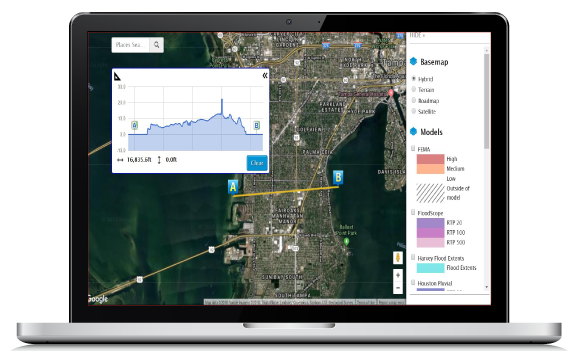

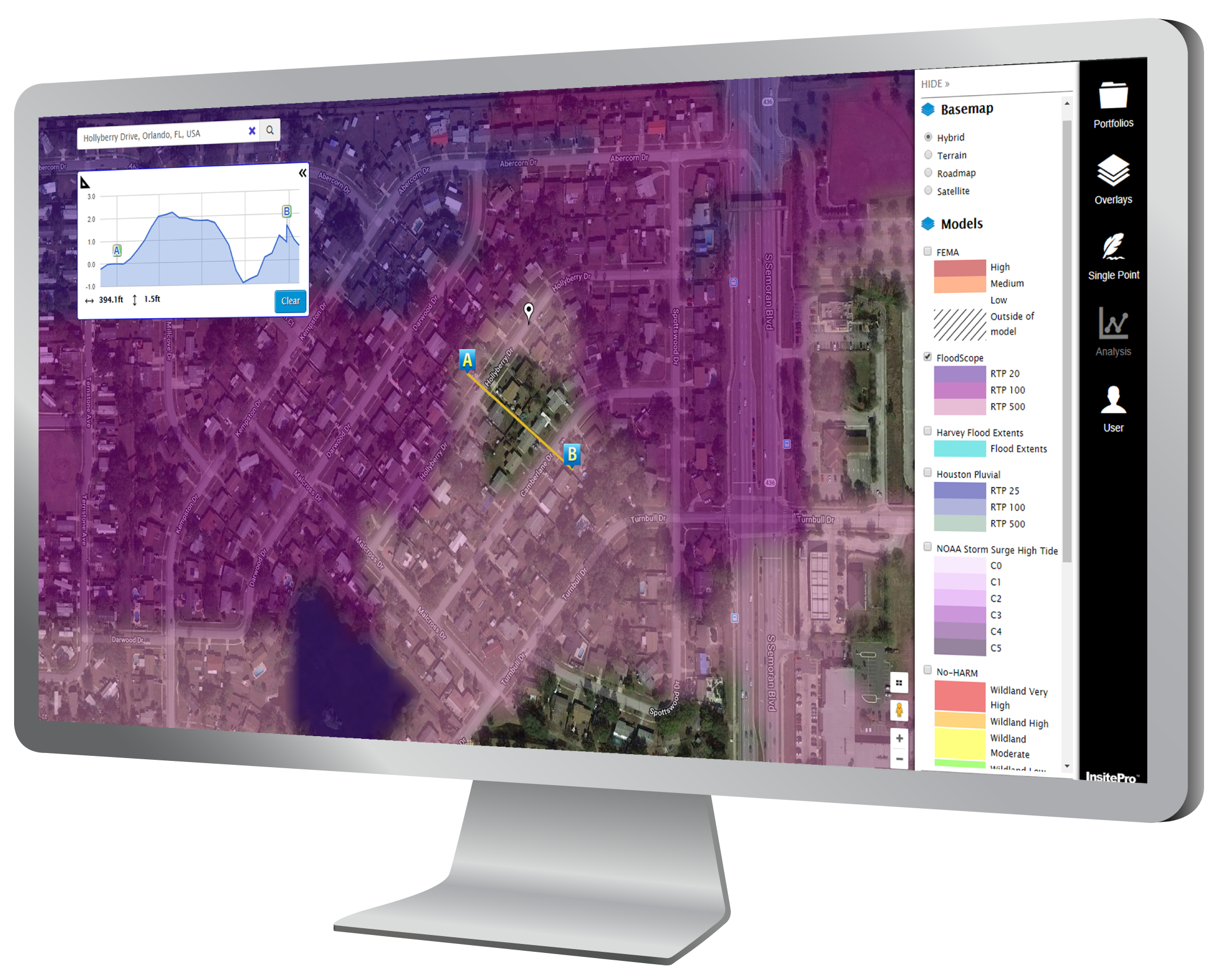

It’s not enough to simply know where the flood zone is.

Detailed elevation and terrain knowledge provides critical insight into which properties will sustain damage … and which will not. Recognizing the difference gives underwriters the ability to expand portfolios and reduce risk exposure.

Our interactive elevation tool enables terrain profiling that clearly shows the shape of the ground at a specific location, indicating how and where water will flow – and which areas will flood first.

Wildfire behavior is a lot less random than many people think. We know. That’s why Intermap has partnered with AnchorPoint to incorporate their National Hazard and Risk Model (No-HARM) into InsitePro.

This model incorporates knowledge of the physical terrain (slope, aspect, elevation) with specific fuel types and climatological information to predict potential fire behavior, including fireline intensity.

With InsitePro, underwriters can assess wildfire risk with a consistent nationwide hazard dataset that expresses the probability and negative effects of wildfire from regional to building-level scales.

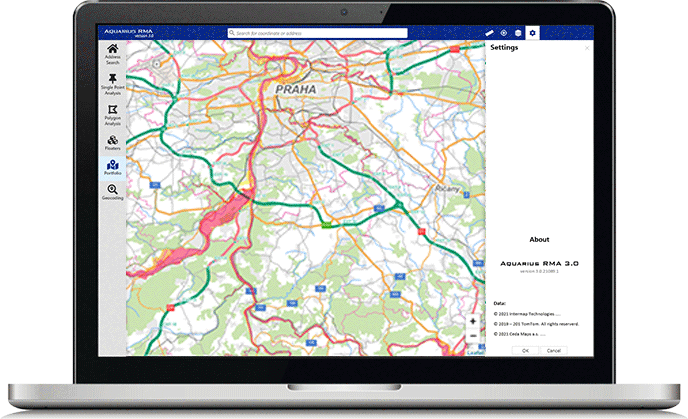

Aquarius RMA is a software, analytics and data solution for quantification of natural hazards and climate change risks. It enables visualization through maps, analysis and aggregation of data in a custom portfolio, creation of statistics and choropleth maps, and calculation of the accumulation of properties. It can also be integrated through internal web services with other applications and systems such as a policy management system, underwriting system, data warehouse, claim management system, and other insurance applications.

For more information visit our European Solutions page.