_Page_1-01.png?width=92&height=119&name=Connecting%20NEXTMap%20in%20Global%20Mapper%20Instructions_v1.2%20(002)_Page_1-01.png)

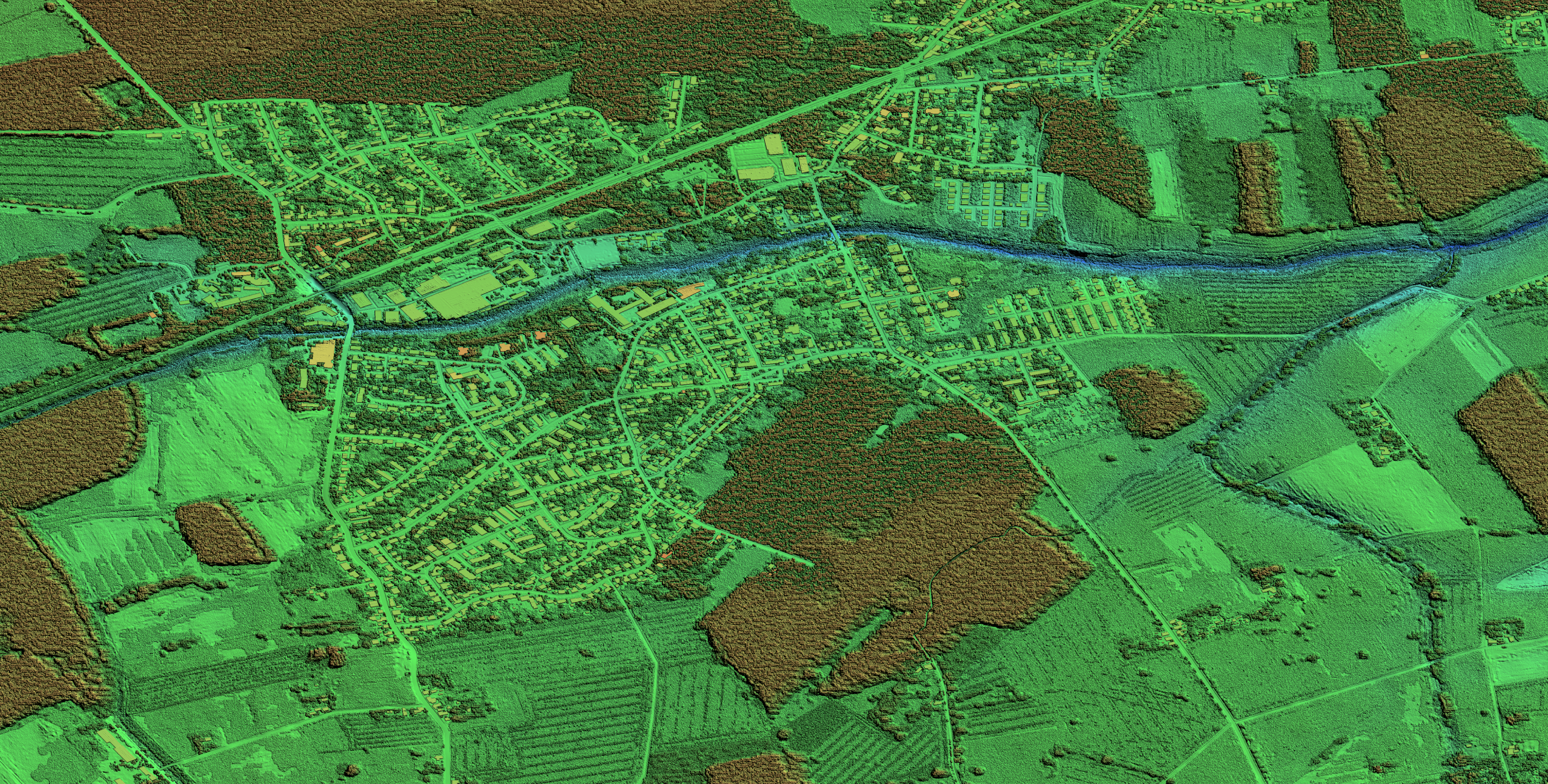

Instruction guide for connecting to NEXTMap in Global Mapper.

NEXTMap data is frequently used with Global Mapper from Blue Marble.

Yes, this can be purchased from Blue Marble.

The most current version, Global Mapper v20.0 or newer.

No, the data is unavailable for export,

For more information on how to load our data into Global Mapper, visit our instruction guide.

NEXTMap elevation data is continually updated with up to 1 million square kilometers per month.

For tile usage, visit your account report.

For tile usage instructions, visit the user guide.

Subscribers have access to 50,000 tiles/month per user.