A few weeks ago there was a piece published on AIR’s In Focus blog about how to use a cat model for underwriting. The piece immediately caught my attention because I spend my days discerning the difference between underwriting and accumulation management/financial modeling. They’re different, and here was an article about how to use one for the other.

A few weeks ago there was a piece published on AIR’s In Focus blog about how to use a cat model for underwriting. The piece immediately caught my attention because I spend my days discerning the difference between underwriting and accumulation management/financial modeling. They’re different, and here was an article about how to use one for the other.

Interesting….

Here is a description of the “Limitations of a Traditional Approach” to underwriting flood:

- Within flood zones, there is a great deal of uniformity in intensity for large geographic areas.

- Outside of the 0.2% (500-year) and 1% (100-year) flood plains, no historical flood intensity information is available.

These are definitely problems for underwriters, and they are well stated. In fact, we couldn’t have said it better.

The solution using a cat model?

To accurately assess the risk, all flood-related actuarial and pricing decisions should involve modeling to capture the associated uncertainty and interdependence in probabilistic outcomes.

And…

The underwriter needs a modeled solution to put historical losses into context and quantify the expected variance of future insured losses.

Does that work?

It’s a bit weak on the first problem, because the same over-generalization (i.e. uniformity) identified as a problem for underwriting is also a problem for the loss modeling. Stochastic modeling doesn’t reduce uniformity (it amplifies it).

On the second problem, it has nothing to say: there is no historical information to put into context, which is the problem in the first place.

Risk assessment software for underwriting flood solves these two problems (because that’s what it’s for):

- With high resolution elevations and flood models driving risk scoring analytics, it is possible to assess flood risk at a very refined level. No uniformity.

- Using more datasets than just flood models (including elevations and source-of-flooding locations) underwriters are not at all limited to any flood zone, anywhere.

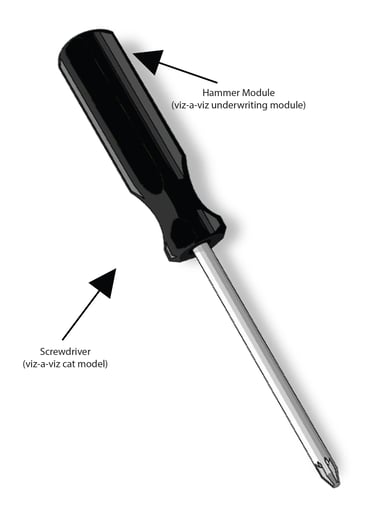

As an aside, I’m not much of a handyman. A part of the reason is that I don’t always have the right tools. Sometimes when I need to drive in a nail, I use the handle of a screwdriver.

I’ve never seen a carpenter do that, though. They ALWAYS use the right tool.