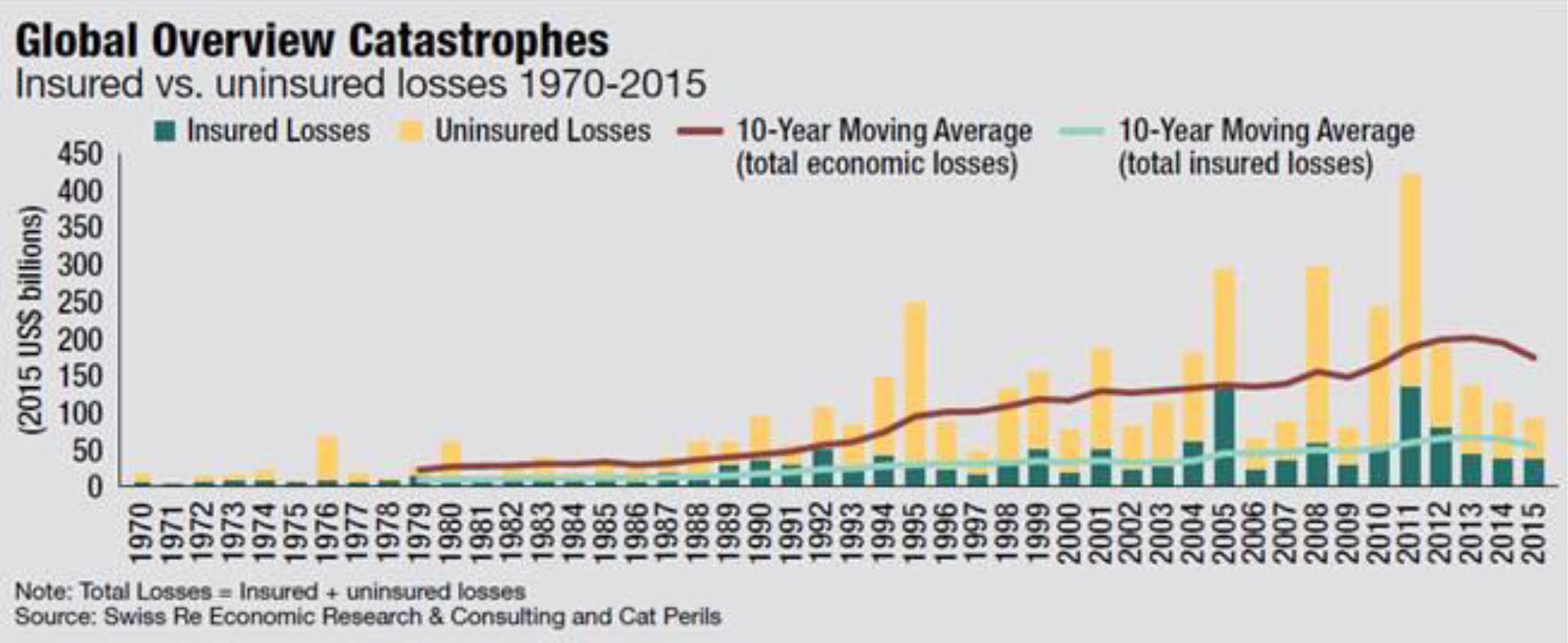

Insurers are posting results for the second quarter now, and cat losses are making headlines. There were certainly a lot of claims, with Q2 driving the highest cat losses seen since Sandy in 2012. The One Brief (from Aon) published an excellent synopsis of the losses here and it makes bleak reading.

On the same day as the Aon article, Travelers published their results. Sure enough, they shared some discouraging news:

- Catastrophe losses of $333 million, up from $221 million for the same period last year, driven by wildfires at Fort McMurray in Canada and hail storms in Texas.

- Net and operating income of $664 million and $649 million, respectively, declined from the prior year quarter, primarily due to the higher catastrophe losses, higher non-catastrophe weather-related losses and lower net investment income.

- It was the smallest quarterly profit since 2012 after superstorm Sandy.