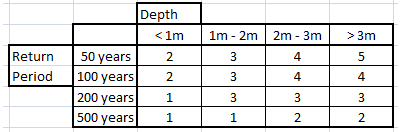

As previously discussed, risk scoring is a powerful way to evaluate risk by including disparate and complex datasets, business rules, and experience — all prioritized and weighted — in an algorithm. While it’s not a new idea, it is underutilized. Therefore, I think it's worth looking at a few examples of how it's done. (Since it’s a vast subject, this post will concentrate on flood risk scoring.)

Topics: Insurance Underwriting, Risk Management, Flood Risk, Risk Scoring

Plug The Leak: Reduce Underwriting Leakage With Better Data

Posted by Ivan P. Maddox on Jun 19, 2018 4:03:34 PM

Not only is insurance an industry that is based on a general inability to predict what is going to happen, it is a hyper-competitive industry in which the winners are those who can best predict the unknowable…or at least be less wrong than their competition. Insurance underwriting is the actual process of pricing what is unknowable, and is necessarily performed with rigorous processes underpinned with vast amounts of data. However, underwriting is never perfect, and the gap between actual underwriting and perfection is called underwriting leakage.

Topics: Insurance Underwriting, Risk Management, Insurance Protection Gap

President Trump signed a hurricane relief bill that includes $16 billion in debt relief for the embattled National Flood Insurance Program. The flood program has a Congress mandated debt ceiling of $30.4 billion, which it reached during Harvey, Irma, and Maria (HIM). This action will allow U.S. Treasury funding of the program.

Is help on the way?

Well, kind of. Premiums are on the rise as the search for actuarial solvency continues for the NFIP. You can read the entire Insurance Journal article from April 5th titled Federal Flood Insurance Average Premium to Rise 8% but here is how it ends: ‘However the premium hikes are likely insufficient to keep the program from sinking into debt, according to a recent government report.’

What is being done currently –

Topics: Flood Insurance, Private Flood, FEMA

Flood poses risk to property and productivity on every continent, and most developed countries have flood insurance available to mitigate that risk. However, everywhere you go, the flood insurance market is different.

There are four principle types of flood insurance models around the world, differentiated by who backs the insurance (government or private markets), and whether it’s bundled or separate from other property insurance coverage (e.g., flood and fire insurance are frequently bundled together).

Each style has its own pros and cons, and each exists in its region for a variety of reasons. Here is a quick look at the four types.

Topics: Flood Modeling, Private Flood, Risk Scoring

It’s spring, which means one thing: The Flood Conference. Oh, it also means flooding in Hawaii, but that’s different.

Topics: Floods, Flood Risk, spring, Flood Conference