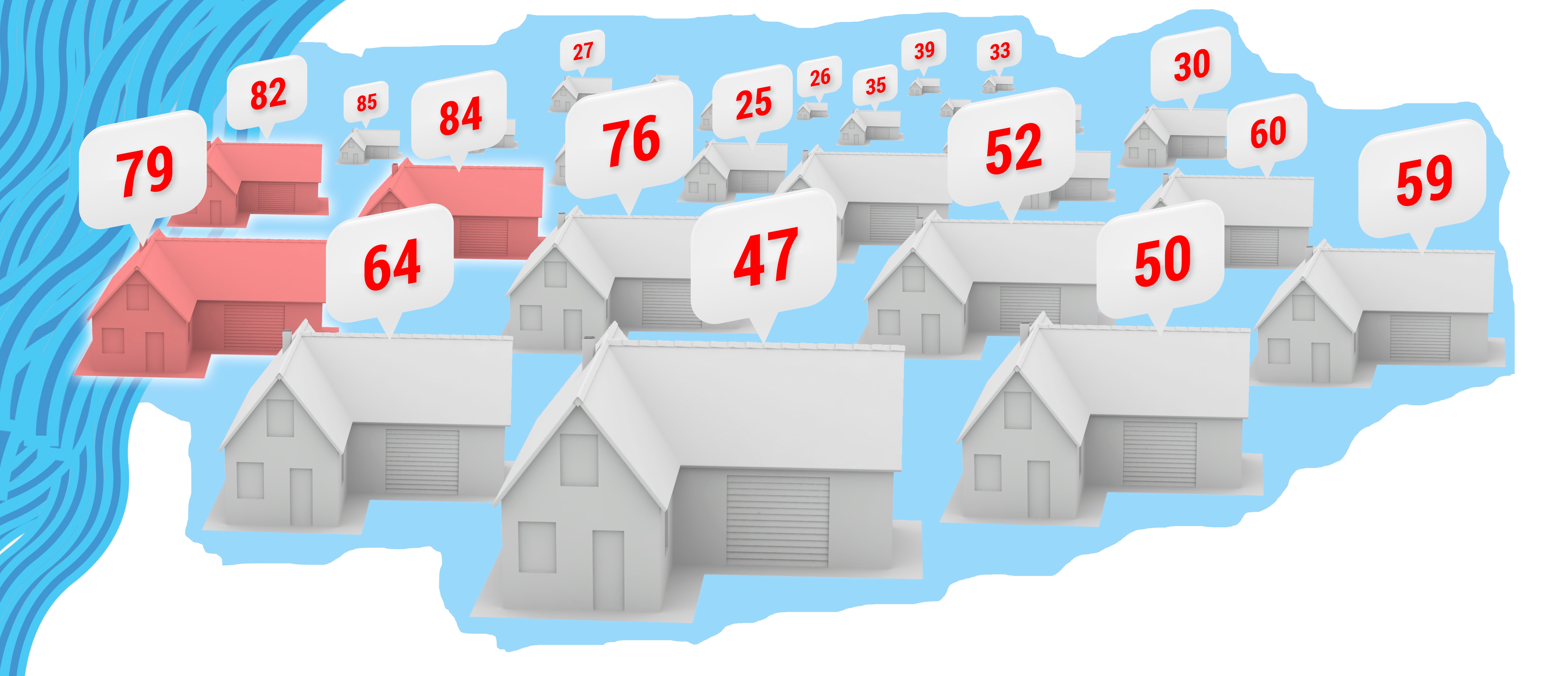

As previously discussed, risk scoring is a powerful way to evaluate risk by including disparate and complex datasets, business rules, and experience — all prioritized and weighted — in an algorithm. While it’s not a new idea, it is underutilized. Therefore, I think it's worth looking at a few examples of how it's done. (Since it’s a vast subject, this post will concentrate on flood risk scoring.)

Topics: Insurance Underwriting, Risk Management, Flood Risk, Risk Scoring

Flood poses risk to property and productivity on every continent, and most developed countries have flood insurance available to mitigate that risk. However, everywhere you go, the flood insurance market is different.

There are four principle types of flood insurance models around the world, differentiated by who backs the insurance (government or private markets), and whether it’s bundled or separate from other property insurance coverage (e.g., flood and fire insurance are frequently bundled together).

Each style has its own pros and cons, and each exists in its region for a variety of reasons. Here is a quick look at the four types.

Topics: Flood Modeling, Private Flood, Risk Scoring

How do you determine risk for a location that has no address?

Posted by Ivan Maddox on Apr 25, 2018 8:00:00 AM

Many solution providers in the market today use addresses as input to determine the risk from multiple perils at a specific location.

Topics: InsitePro, Risk Management, Risk Scoring

Feds Underestimating Flood Risk and ‘The Strangeness Index’

Posted by Bill Raymor on Mar 14, 2018 8:00:00 AM

PropertyCasualty360 published an article in December, 2017 that begins with this eye-opening quote, “Research conducted by a team of U.S. and U.K. scientists and engineers suggests that U.S. federal flood maps underestimate the number of Americans at risk for flood by more than 27 million people.”

A study from IOPscience gave a more onerous estimate of 41 million Americans living on the 100 year floodplain. And, with a value of $5.5 trillion! In contrast, current FEMA estimates are around 13 million Americans.

At the 2017 American Geophysical Union Meeting Dec. 11-15 in New Orleans, scientists presented a ‘redrawn’ flood map of the U.S. (coastal areas excluded) simulating every river catchment area. Intermap’s InsitePro flood mapping tool uses a mathematical tree structure called the Strahler Number to predict risk. It is a numbering system that correlates a numeric value to stream size from small tributaries to large riverways. The entire algorithm then uses our proprietary 5m seamless & contiguous bare earth elevation dataset to generate location specific flood risk scores.

Topics: Floods, Flood Insurance, Flood Risk, Risk Scoring, FEMA

Here we are at the end of November, with the HIM storms in the relatively distant past. By now, it should be clear if cat/flood rates would be hardening or not. Especially, one would think, with reinsurance renewals bearing down.

Topics: Flood Insurance, Risk Scoring, NFIP