The past year was a tough one for US cat losses, especially wildfire and flood. Last week we explored just how bad it was, but also just how much opportunity does exist in the US protection gap. The secret to unlocking that opportunity, without undue overexposure, is crisp underwriting.

Topics: Insurance Protection Gap, Effective Underwriting, Perils

This week I’m attending the Singapore International Reinsurance Conference (SIRC), the largest Asian gathering of the reinsurance industry, including brokers and reinsurers, and the cedants who are their clients. The first thing I learned is that reinsurers are rejecting their recent labeling as “traditional reinsurers”, as new “alternative” capital moves into reinsurance. They now prefer to call themselves “professional reinsurers”. Sounds good!

Topics: Flood Insurance, Insurance Protection Gap, Effective Underwriting

As ever, time is flying, and it’s almost the holiday season of 2017. The good news about fast moving calendars is that we can get to our latest Top 3 blogs from the summer.

Topics: Geocoding, Effective Underwriting, NFIP, Houston

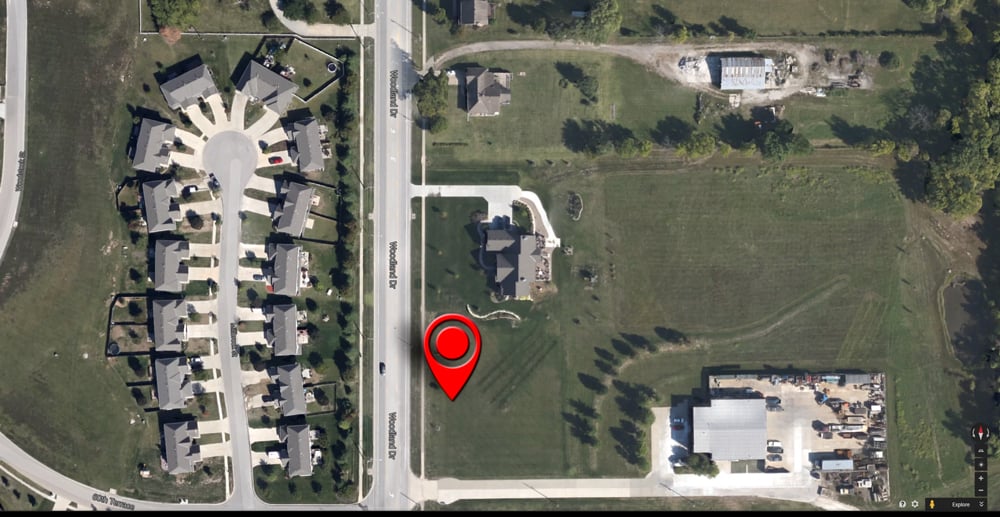

As risk assessments get better and better, the limiting factor on how well they work is almost always geocoding. A long time ago, we took a look at geocoding for underwriting, which discussed how important it is. Well, everything in early 2015 that was true and valid remains true and valid.

What would an underwriter say if they heard that a monumental amount of unwritten premium was about to become available in a few months? This is something property underwriters are contemplating as the NFIP re-authorization approaches. But is that the right question?

Topics: Insurance Underwriting, Underwriting Profit, Effective Underwriting