While reading Gallagher’s CEO first quarter synopsis (Best’s, subscription required) I was interested by his thoughts on the flat rate market in property insurance:

"I've never lived this way before," he said. "It's either one way or the other, where you've got rates coming down substantially and you're shopping everything, or rates are going up and you're scrambling to get the coverage you want."

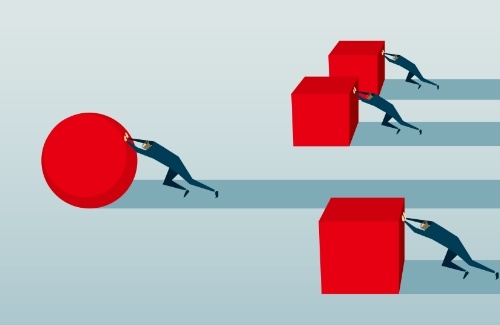

He continues by describing how comfortable he is in such an environment because his company is built for competition: “Give us a stable rate environment and … we will drive organic growth."