In the United States, ZIP codes are universally understood proxies for location. People often instantly recognize an address’s state or region from the first digit or two, and sometimes a full ZIP becomes well known (e.g., 90210 for Beverly Hills).

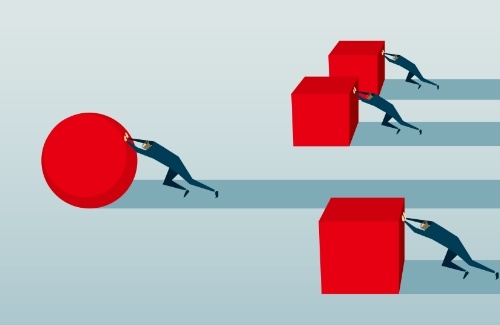

But these days, ZIP codes do much more than route mail. They are used for things like credit card identity checks; demographic data collection by the U.S. Census; real estate pricing and marketing; and (incongruously) property insurance risk rating, accumulation, and reporting. That last one may come as bit of a surprise, so let's take a look at how insurance companies use ZIP codes — and whether or not their methods make sense.