Severe Convective Storm is, generally speaking, the type of storm responsible for damage from tornado, hail, “straight-line” wind (i.e., not a tornado), and lightning. (For a more thorough, academic definition of SCS I will point you toward the American Meteorological Society.) Recently, I have begun researching how to present risks related to SCS in the USA and Canada, and I've come across some interesting challenges.

Severe Convective Storm is, generally speaking, the type of storm responsible for damage from tornado, hail, “straight-line” wind (i.e., not a tornado), and lightning. (For a more thorough, academic definition of SCS I will point you toward the American Meteorological Society.) Recently, I have begun researching how to present risks related to SCS in the USA and Canada, and I've come across some interesting challenges.

Modeling these types of natural events to a level where individual properties can be evaluated is not easy, if it’s even possible. There is no direct influence from anything in a fixed location (terrain, vegetation, etc.) — all the primary drivers are atmospheric. So, unlike flood or wildfire, SCS risk models need to portray the likelihood of an event that could happen anywhere (within certain bounds). Not an easy task.

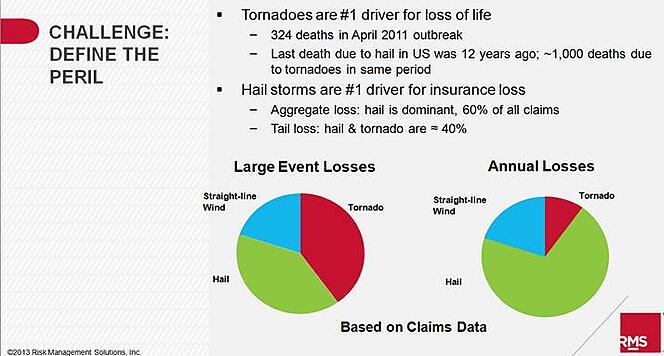

One aspect of these models that strikes me is that they combine all four perils into one peril. I, for one, am struggling to understand why hail and tornado are not treated as separate perils, especially considering:

- Hail is by far the largest SCS loss driver for residential properties in the USA.

- Meanwhile, tornadoes kill more people than any other SCS peril.

- The damage potential is vastly different, with hail limited to roof, siding, and cars, while a tornado can wipe out the whole house.

- At my house in Denver, we get at least four or five hailstorms each year, but no tornado has been within 10 miles of the house. (I admit this is a narrow and limited view, but hey, it’s very immediate!)

As per Risk Management Solutions:

Why don’t property insurers demand separate models for hail and tornado? They are completely different perils that presumably need to be evaluated, rated, and priced differently. They cause different types of losses at different frequencies.

Over the coming months, Intermap will be working on risk models for both perils, probably keeping them separate. If you have any thoughts or input into this, please let me know in the comments below!