These days, business software (and technology in general) evolves faster than ever before. Users have access to rapidly improving analytics based on huge datasets; flexibility on how questions are asked; and — most importantly — how answers are received and interpreted.

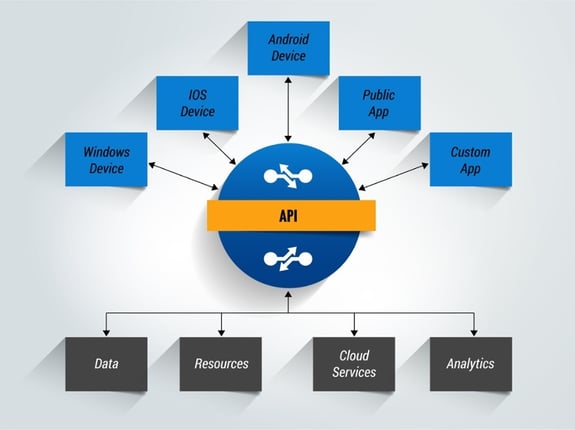

In the past 10 years or so, business systems have moved from desktop-based programs to much more dynamic applications that are simultaneously more specialized and more universal. Business solutions now leverage more data to deliver answers that are very specific to an industry, to an organization, and to specific users. There are several technological cornerstones that make today’s systems so powerful, and one of them is the Application Programming Interface, or API.

How do APIs play such a big role in today’s software? Well, they're like LEGO blocks.

In the 70s, LEGO pieces were all very big and chunky. Today, the pieces are typically much smaller and designed for specific uses when building something. The average piece of LEGO in the 70s had about eight pegs on it, while now, I'd say the average is under two. (I made these numbers up, based on my experiences playing with LEGOs when I was a kid and with my daughter’s LEGOs today).

Furthermore, in 1975 there were under 500 individual elements compared to nearly 10,000 today (I didn't make these numbers up). When I made an airplane as a kid, everything was boxy; the wings and fuselage were rectangles. Now, my daughter and I can build an airplane with swept-back wings, a nose-cone, a tubular fuselage, and realistic engines — all with pieces that are standard.

It’s the same with software, which is now built in many small component pieces, all connected easily with APIs. The term for software built like this is “platform architecture”.

For property insurance software, platform architecture has many advantages:

- Insurance systems depend upon connections between several different types of software, including underwriting, accumulation, accounting, marketing, sales, etc. (the list really does go on and on). APIs enable connections between these different types of software. API connections ensure data is quickly moved from where it’s stored or generated to where it’s needed.

- APIs ease the use and management of huge datasets (e.g. claims history, actuarial info, financial records, portfolios of policies, etc.) in three primary ways: by enabling specialized analytics; by making it possible to keep the datasets in a central location instead of copying it everywhere it’s needed; and by requiring that only one copy of the dataset is up-to-date and complete.

- If a piece is missing from an existing platform software, such as a unique risk score from underwriting software, it is not necessary to replace the whole software package to get it. With APIs, the analytic can be integrated seamlessly into the existing software.

- If software needs to do something a little bit differently, APIs make little tweaks much easier. In the past, full customization might have been needed, incurring a huge expense. Now, because analytics can be built with small, refined components, “customization” has become “configuration." In other words: What was once long and complex is now quick and easy.

- APIs ensure software is updated (and upgraded) more frequently. As specific building blocks are upgraded, the whole solution is also upgraded because the associated API changes are easy.

- Mobile solutions depend on APIs because hand-held devices are too small to do the necessary work themselves. Instead of actually processing, they interact by API with more powerful computing systems and datasets somewhere else (usually in the cloud).

The property insurance software market is full of platform-based solutions that support all aspects of the business — from marketing and sales, to risk assessment, underwriting, accumulation, and finance. Insurance is particularly well suited to platform software: Business is conducted in offices and agencies around the globe, and all of them depend on the efficient creation, transfer, and consumption of data and information. As legacy monolithic software is replaced by dynamic platform software built with small API-connected components, insurance organizations are changing in exciting new ways because their software is more flexible, while being better suited to solving their specific problems in the ways they want to solve them.

To learn more about how Intermap uses APIs to integrate data, software, and services through our Orion Software Platform, please visit our website.