Imagine for a moment that your home has been damaged, and you and your family need to move out for a few months while it’s repaired. The more you think of it, the more the extra expenses add up – rent, extra groceries because you have a smaller fridge, extra commuting costs, and on and on. Luckily there is insurance for this: loss of use.

The American Insurance Association defines loss of use as the extra expenses incurred because of property damage. Three types of coverage are usually included: additional living expense; fair rental value; and, in most states, prohibited use (i.e. you can’t access your home because of something happening around it, even though there is no damage at your place). Essentially, you can claim any expenses or loss of rental income caused by your property being out of commission.

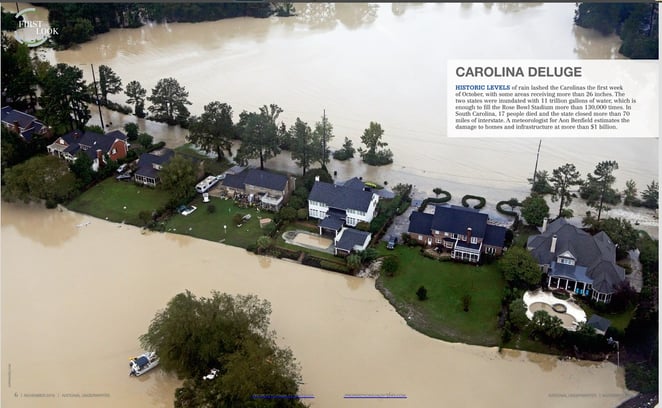

Even if not flooded, there is still a loss – loss of use. Image from National Underwriter, November 2015 issue.

Even if not flooded, there is still a loss – loss of use. Image from National Underwriter, November 2015 issue.

Loss of use is a coverage that is associated with natural catastrophes more than anything; the most likely reason you can’t stay in your home is because of a flood, wildfire, earthquake, or hurricane. But, and this is a big but, for the cover to be valid, the damage must be caused by an insured peril. Almost every homeowner’s policy in the US excludes flood and earthquake. Wildfire is also a very common exclusion. If a home is damaged by these natural disasters, not only is the damage not covered by insurance, neither is the loss of use. Homeowners need to make sure they have those perils covered if they want to be insured for loss of use.

Policies from the California Earthquake Authority offer loss of use for a little additional premium. The terms are okay, too, with no deductible and a standard limit of $25,000. For flood, though, it’s not so good. National Flood Insurance Program policies do NOT cover loss of use. If your home floods, and you’re one of the minority who actually has flood insurance, you will not be able to claim any loss-of-use expenses. After Sandy, how much was spent by homeowners in the Northeast in the months after the storm before they even began on the repairs?

Property insurers should not only be leveraging new technology and analytics to offer flood insurance in the United States – they should be thinking of making flood a standard peril, and delivering real value to homeowners with coverage that will really help them if they need it. Loss of use is an example of the coverage gap that needs to be filled by a responsive insurance industry.