With my last blog post of 2015, it’s time to honor the tradition of making predictions for the coming year. It is an especially fitting way for Risks of Hazard to end the year since we explore underwriting analytics that help underwriters understand the chances of something happening in the future.

Ivan Maddox

Recent Posts

One of the key attributes of a flood model is the Base Flood Elevation, or BFE. It represents the elevation of the water surface during a perfectly calm flood of precisely defined annual probability – in other words, it’s a fiction. Happily, it is a very useful fiction.

The context in which most people are familiar with BFE is through the FEMA FIRMs. For many (but not all) Special Flood Hazard Areas (SFHAs), FEMA publishes a BFE – i.e. the elevation of the water during a flood that would mimic the relevant A or V zone. To obtain a Letter of Map Change from FEMA, and to be excused from the regulations governing a property within an SFHA, a homeowner needs to demonstrate that their ground floor elevation is above the BFE. In other words, a 1% flood would not get their front door wet.

Topics: Risk Management, Flood Modeling, Risk Models

Last week BuzzFeed ran a piece on the New Madrid Seismic Zone, a sometimes-forgotten and sometimes-remembered seismic zone in the middle of the United States that could potentially cause over $100B in damage. We took a look at New Madrid earlier this year (though at that time, I couldn’t pronounce New MAD-rid properly), specifically at how only 20% of the homes in the exposed region are insured for quake based on work by Swiss Re.

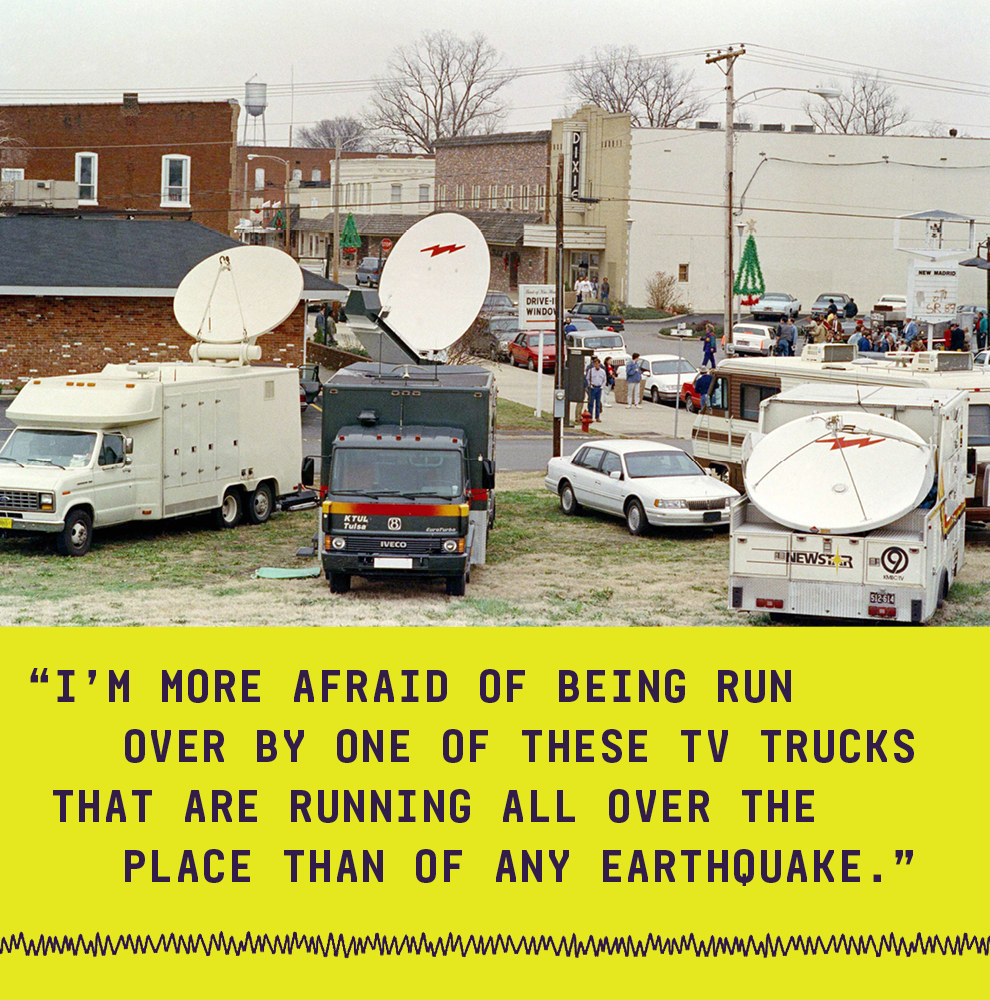

The BuzzFeed article, The Day the Earth Stood Still by Thomas Gounley, looks at a day 25 years ago this month when the big earthquake was predicted to hit the area. The article is not about geology or seismology, per se, but rather how a certain Iben Browning predicted (with 50% certainty!) that an earthquake would hit New Madrid on December 3, 1990. Needless to say, nothing happened. The article describes the media circus and shows the fun people had on their marquee signs, as well as taking a look at the underlying science of the fault zone.

Topics: Property Insurance, Earthquake

A few months ago, Dr. Anand Rao of PwC published an article in Carrier Management that explored a few of the psychological barriers to innovation. It was an article that stood out because it’s not really insurance-focused, but entirely relevant to insurance and its laggard approach to innovation thus far (right, Mr. Wilson from Aviva?).

Dr. Rao identifies three biases that sand the skids of change. Here they are, quoting his article:

- Status Quo Bias: Over the past couple of decades, behavioral economics has documented human bias toward the status quo. This individual bias manifests itself at the organizational level, as well—very seldom do organizations willingly want to change—and change usually occurs because of external factors.

- Risk Aversion: Evolution has programmed us to avoid risks. The amygdala, the integrative center for emotions in the brain, inclines us to avoid risks. This individual trait carries over to most institutions, except for the few that deliberately have been designed to be risk-seeking. By their very nature, most insurers are very careful about which risks to take.

- Self-Serving Bias: People often conflate what is fair with what benefits oneself. Similarly, we are open to making by gut instinct decisions that favor ourselves.

Topics: Risk Management, Insurance Technology

Last week, during the lull of Thanksgiving, AM Best published one of their most interesting articles of the year (mind the subscription wall). Regular readers of the Risks of Hazard will know that a study called Systemic Risk of Modelling in Insurance: Did your model tell you all models are wrong? is a winning topic. Thank you to the authors at Amlin and Oxford for initiating this three-year study (which is just getting going).

Topics: Risk Models, Risk Scoring