President Trump signed a hurricane relief bill that includes $16 billion in debt relief for the embattled National Flood Insurance Program. The flood program has a Congress mandated debt ceiling of $30.4 billion, which it reached during Harvey, Irma, and Maria (HIM). This action will allow U.S. Treasury funding of the program.

President Trump signed a hurricane relief bill that includes $16 billion in debt relief for the embattled National Flood Insurance Program. The flood program has a Congress mandated debt ceiling of $30.4 billion, which it reached during Harvey, Irma, and Maria (HIM). This action will allow U.S. Treasury funding of the program.

Is help on the way?

Well, kind of. Premiums are on the rise as the search for actuarial solvency continues for the NFIP. You can read the entire Insurance Journal article from April 5th titled Federal Flood Insurance Average Premium to Rise 8% but here is how it ends: ‘However the premium hikes are likely insufficient to keep the program from sinking into debt, according to a recent government report.’

What is being done currently –

- Move to Privatize

- Congress has once again extended until July 31st funding for the NFIP.

- An article titled ‘State of Flood Insurance in the US’ sponsored by Carrier Management in March of this year is full of information regarding admitted carrier participation in the Private Flood market for both commercial and residential properties.

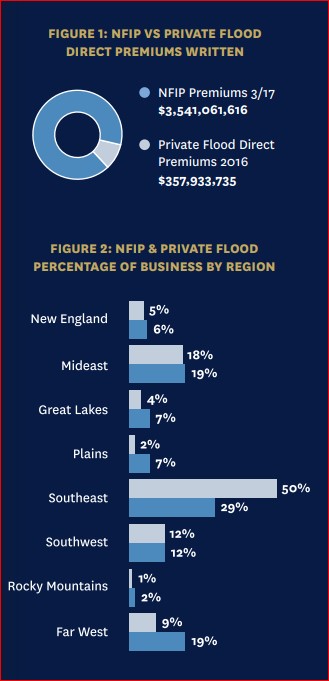

- This is a quote from this report: ‘At year end 2016, the admitted property casualty insurance carriers report nearly $358 million in direct premiums written across the United States. This equates to 9% of the market largely monopolized by NFIP, based upon NFIP direct premiums written as of March, 2017'.

Source: https://www.insurancejournal.com/research/app/uploads/2018/03/State-of-Flood-Insurance-RTVersion.pdf

Source: https://www.insurancejournal.com/research/app/uploads/2018/03/State-of-Flood-Insurance-RTVersion.pdf

Reinsurance

- Financial facts from FEMA’s effort to offset losses:

- As of April 2, 2018, FEMA has paid over $8.6 billion in losses to policyholders as a result of Hurricane Harvey. Because FEMA purchased reinsurance in 2017, FEMA recovered $1.042 billion from its reinsurers.

- For 2018, continuing this practice of resiliency and protection against future flood losses, FEMA secured $1.46 billion in reinsurance to cover any qualifying flood losses in excess of $4 billion per event occurring in calendar year 2018.

- Under the 2018 reinsurance agreement, reinsurers agreed to indemnify FEMA for flood claims on an occurrence basis. The agreement is structured to cover 18.6 percent of losses between $4 billion and $6 billion, and 54.3 percent of losses between $6 billion and $8 billion. FEMA paid a total premium of $235 million for the coverage. https://www.fema.gov/

Insurance Linked Securities (ILS Cat Bonds)

Insurance Journal reported in an April 5th article: ‘FEMA to Issue First Catastrophe Bond for Flood Insurance Program’ as another attempt at more diversification of NFIP debt scheduled around mid-year. Here’s Roy Wright, ex director* of the NFIP: ‘The NFIP requires a stronger financial framework built on expanding our portfolio of actuarially-priced policies. Transferring more of the risk burden to the private capital markets continues to be part of that strategy'. https://www.fema.gov/

Will it be enough?

Even with the small but gallant diversification efforts being undertaken by FEMA,the reinsurance efforts yielded only about 12% cost effectiveness, and the Cat bond solution is yet to materialize. The private market option seems destined to offer more coverage (often at a better price point) and protect us from another multi-billion-dollar bailout of our tax dollars.