AM Best has published their annual look at World Catastrophes for 2015 (mind the subscription wall). The main three overall takeaways from 2015 are:

- The largest cat loss of the year was man-made. The explosion in Tanjian, China, caused more insured losses than any natural catastrophe last year, and was the third costliest man-made disaster for insurers in history.

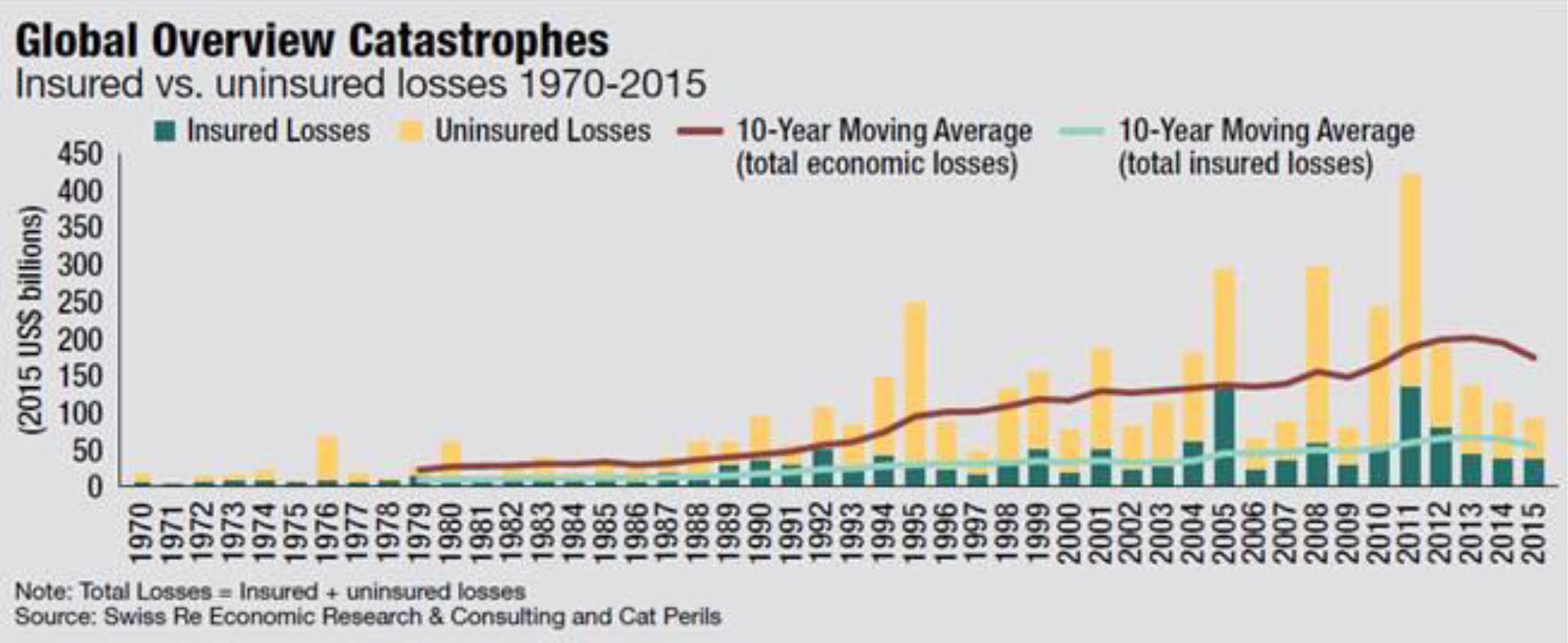

- Overall, it was another quiet year for cat losses. See Graphic 1 for an historical look.

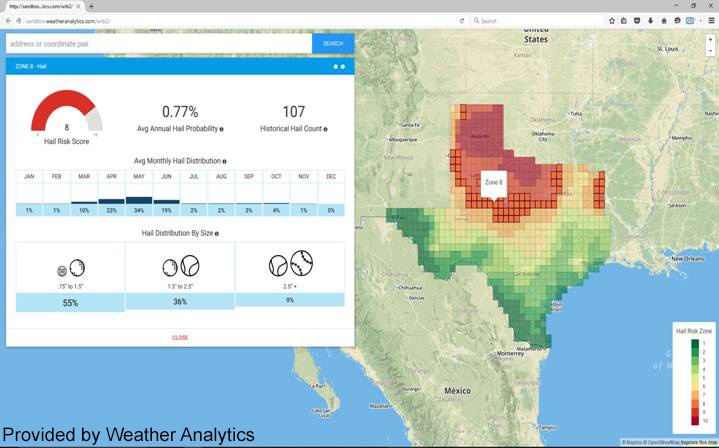

- The Protection Gap was huge enormous gigantic, especially in Asia. See Graphic 2 for the gap between total and insured losses. Light green = Gap.