Wow, 2016 is now half over. It has been an eventful half year, including private flood legislation coming closer to implementation and historic wildfires in Alberta and California.

Ivan Maddox

Recent Posts

Topics: Flood Insurance, Insurance Underwriting, Flood Modeling, Flood Risk, Effective Underwriting

One of the most enduring insurance news stories of 2016, so far, has been private flood insurance in the United States. I've also covered it heavily right here in the Risks of Hazard. Regulations are evolving to support it, and the number of insurers offering it is growing steadily. For insurers entering the market, one of the key technical problems to solve is how to rate the flood risk at a given property in a way that lets them determine pricing and conditions independently of NFIP information.

Topics: Flood Insurance, Insurance Software, Private Flood

What Cat Underwriters Need to Know from 2015, for 2016.

Posted by Ivan Maddox on Jun 29, 2016 7:12:00 AM

AM Best has published their annual look at World Catastrophes for 2015 (mind the subscription wall). The main three overall takeaways from 2015 are:

- The largest cat loss of the year was man-made. The explosion in Tanjian, China, caused more insured losses than any natural catastrophe last year, and was the third costliest man-made disaster for insurers in history.

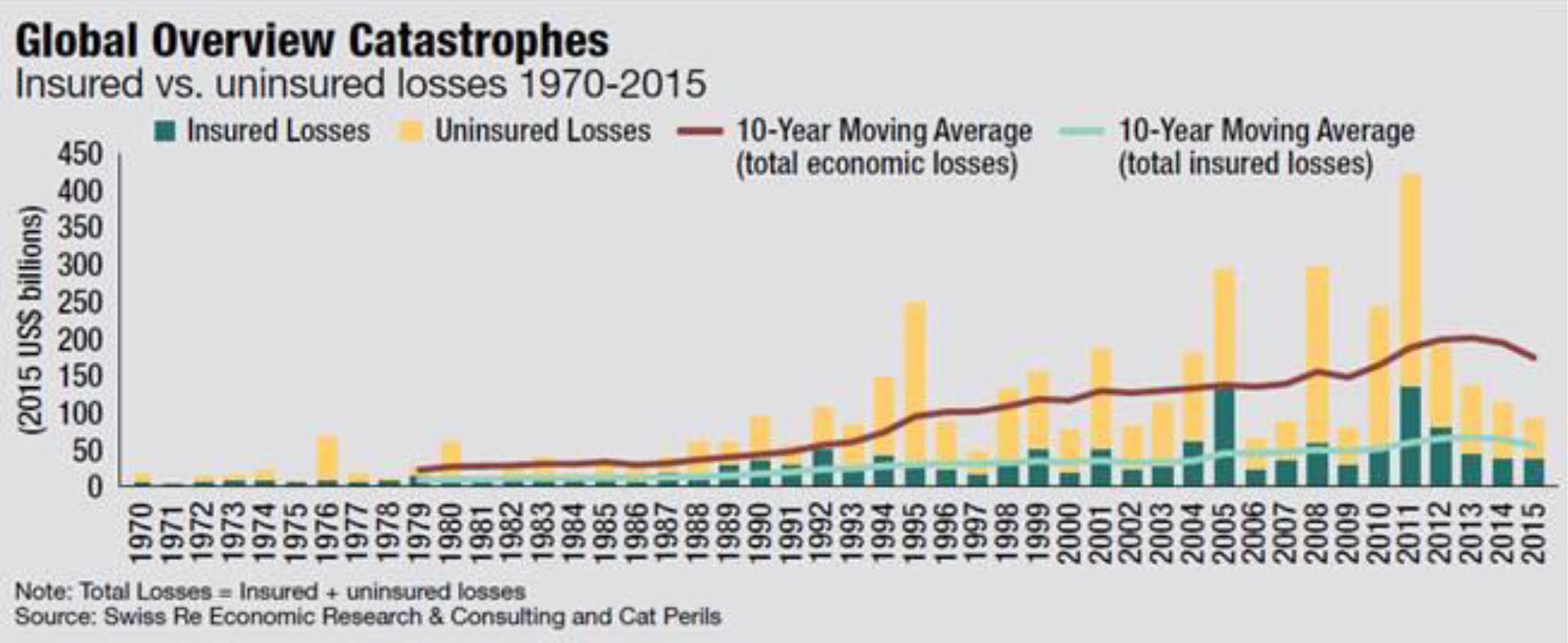

- Overall, it was another quiet year for cat losses. See Graphic 1 for an historical look.

- The Protection Gap was huge enormous gigantic, especially in Asia. See Graphic 2 for the gap between total and insured losses. Light green = Gap.

Topics: Floods, Natural Catastrophe, Wildfire, Hail, Insurance Protection Gap

Earlier this month the New York Times published an op-ed piece discussing the new FIRMs in New Orleans. Now, if ever there were going to be contentious flood maps published by FEMA, these would be them. It is nigh impossible to discuss flood mitigation or flood risk in that city objectively after Katrina.

The author, Andy Horowitz (an assistant professor of history at Tulane), states his intent early: “I was briefly elated — and then, horrified — when, earlier this year, the federal government declared most of New Orleans safe from flooding.” At length, here is the cause for his concern:

Topics: Insurance Underwriting, Flood Risk, Hurricane, Private Flood, Risk Scoring

All the Possible Ways

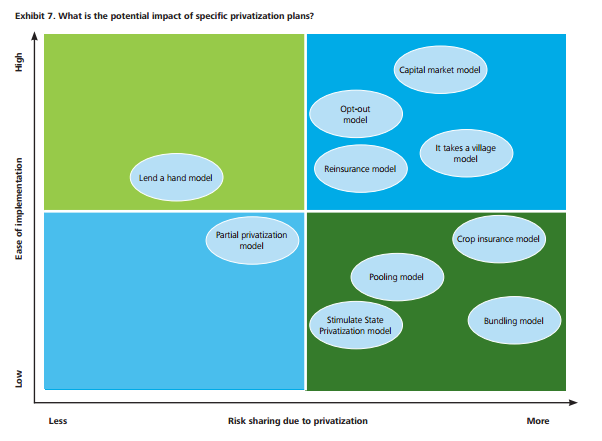

In 2014 Deloitte published a research paper entitled The potential for flood insurance privatization in the U.S. Could carriers keep their heads above water? A few days ago, we did an overview with a deep look at the key problem and solution. Today is a review of their survey of all the available ways that private flood can be introduced into the US market.

Below, in the graphic from Deloitte, are the ten possible ways for private flood insurance to happen, all plotted on a chart depicting increasing Ease of Implementation and Risk Sharing (page 11 of the report).

There they are: ten ways to introduce private flood. There might be more, but I can’t think of any. In the report, each is defined. Let’s take a look at a selection of them:

Topics: Flood Insurance, Risk Models, Private Flood