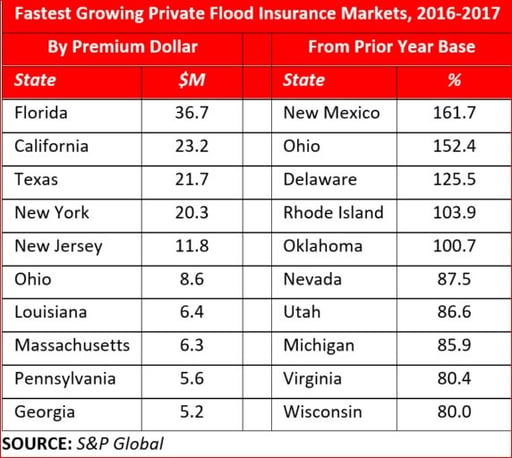

A tumultuous U.S. Nat Cat 2017 year bookended by huge first quarter losses from hail and tornado and an estimated $50bn+ insured losses from HIM (Harvey, Irma, and Maria) still did not impede the private flood insurance market from growing by 51.2% according to information referenced in an Insurance Journal article published on March 18th of this year. That news comes despite Congress’ delay in reform and reauthorization of the NFIP, currently +-$25 billion in debt (pre HIM).

The need for Private Flood is staggering! The actuarial firm Milliman published a study finding that “69 percent of Louisiana property owners, 77 percent of Florida property owners and 92 percent of Texas property owners could find more affordable options in the private market than through the NFIP.”

Better Data = Better Analytics

In a previous blog titled Feds Underestimating Flood Risk and “The Strangeness Index” (no pun intended), reference is made to an IOPscience article stating that ”41 million Americans live within the 1% annual exceedance probability floodplain (compared to only 13 million when calculated using FEMA flood maps).”

Better Analytics = Better Profitability for the Private market

A McKinsey & Company article from December of 2017 by Michel-Kerjan and Giambattista Taglioni titled “Insuring hurricanes: Perspectives, gaps, and opportunities after 2017” is a fascinating study filled with facts, figures, analyses, and suggestions (What?) that end with this statement: “We estimate that this course of action, if risk-based, could represent $30 billion to $50 billion in written premiums annually (residential and small business combined) and better protect the United States against economic flood losses.” (Hint: it’s at the end of Question 4).

The pieces are in place. Relevant, accurate information exists to provide underwriters the capability to make location based decisions with confidence.