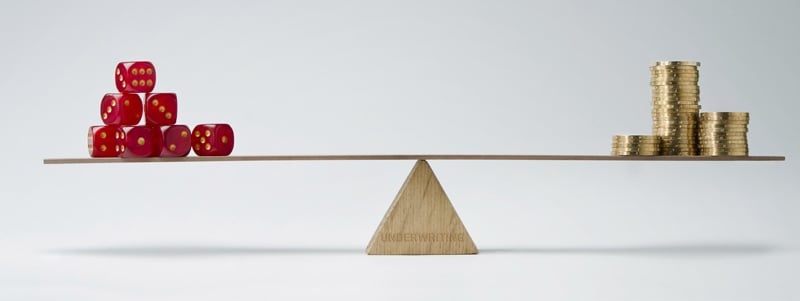

The assignment of a price to a risk is the core activity of insurance, and underwriting is the fulcrum on which risk and money balance. Any difference between perfection and reality in that balancing act is called underwriting leakage. Let’s explore two results of that leakage:

- Premiums become volatile after a natural catastrophe event

- A coverage gap in the risk pool occurs

1. Volatile Premiums

Underwriting leakage for natural catastrophes becomes obvious after a bunch of claims are paid: prices go up within a year or two. While these premium increases are considered a necessity by insurers, it is a source of frustration to consumers and anxiety to regulators. Consumers don’t like premium rises, and regulators don’t like unpredictable pricing because they don’t like unhappy consumers (i.e. voters).