One of the most enduring insurance news stories of 2016, so far, has been private flood insurance in the United States. I've also covered it heavily right here in the Risks of Hazard. Regulations are evolving to support it, and the number of insurers offering it is growing steadily. For insurers entering the market, one of the key technical problems to solve is how to rate the flood risk at a given property in a way that lets them determine pricing and conditions independently of NFIP information.

Topics: Flood Insurance, Insurance Software, Private Flood

All the Possible Ways

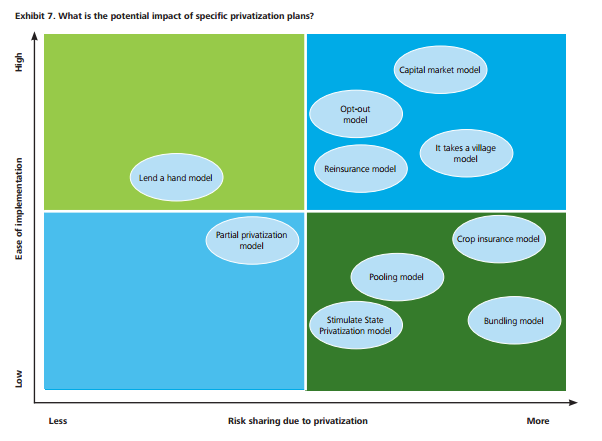

In 2014 Deloitte published a research paper entitled The potential for flood insurance privatization in the U.S. Could carriers keep their heads above water? A few days ago, we did an overview with a deep look at the key problem and solution. Today is a review of their survey of all the available ways that private flood can be introduced into the US market.

Below, in the graphic from Deloitte, are the ten possible ways for private flood insurance to happen, all plotted on a chart depicting increasing Ease of Implementation and Risk Sharing (page 11 of the report).

There they are: ten ways to introduce private flood. There might be more, but I can’t think of any. In the report, each is defined. Let’s take a look at a selection of them:

Topics: Flood Insurance, Risk Models, Private Flood

Flaws and All

In 2014 Deloitte published a research paper entitled The potential for flood insurance privatization in the U.S. Could carriers keep their heads above water? Despite the marks the authors might have lost in the “Title Brevity” category, they more than redeemed themselves in the all-important “Usefulness” category. This is a white paper that anyone underwriting, contemplating, competing with, or studying private flood should read, over and over. It is such a rich vein of material that The Risks of Hazard is going to write two posts on it this week. Today, we will provide an overview that includes a deeper look at the key problem and solution. Later this week, we will review their survey of all the available ways that private flood can be introduced into the US market.

The title of the introductory section reveals the conclusion: Greater privatization may provide growth opportunities, but leveraging them might be problematic. It is a very safe, uncontroversial conclusion, which makes sense because it was written 2 years before the current private flood legislation is on its way to becoming law. The first half dozen pages of the report offer an orthodox summary and summation of the NFIP, its travails and its successes (yes, it has been a success for some – especially lenders).

Then it gets more interesting.

Topics: Flood Insurance, Insurance Underwriting, Flood Risk, Private Flood, Insurance Protection Gap

Earlier this month I published a post on LinkedIn about underwriting “challenging” flood in California’s Central Valley. It generated a decent readership and some likes, but, most importantly, it generated some comments. One of the comments posted was a very prescient piece of commentary, and it deserves a blog post to explore the topic it raised: The limitations of analytics.

The comment came from Mr. Tim Pappas (a VP at Gen Re), and I am grateful to him for raising this important topic. Here are the points he raises that this post will address:

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.- The picture may not be quite as clear as the “high resolution” data provided indicates.

- The complexity of all the factors involved can lead to errors in estimation, making the computations imprecise and sometimes outright faulty.

- If the data is off on just a small percentage of risks, the impact on portfolio profitability can be quite large.

Topics: Flood Insurance, Insurance Underwriting, Flood Modeling, Flood Risk

Last week I wrote about the Protection Gap and how insurers should be serving it. The post has been a huge success, mostly because it features Hemant Shah, CEO of RMS (thank you Mr. Shah!). The article pivoted on the question “What risk is the insurance industry not ready to handle?” and Mr. Shah’s response:

“I worry more about the risks the insurance industry is not covering right now.”

Topics: InsitePro, Flood Insurance, Earthquake, Insurance Technology, Insurance Protection Gap

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.