Earlier this month I published a post on LinkedIn about underwriting “challenging” flood in California’s Central Valley. It generated a decent readership and some likes, but, most importantly, it generated some comments. One of the comments posted was a very prescient piece of commentary, and it deserves a blog post to explore the topic it raised: The limitations of analytics.

The comment came from Mr. Tim Pappas (a VP at Gen Re), and I am grateful to him for raising this important topic. Here are the points he raises that this post will address:

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.

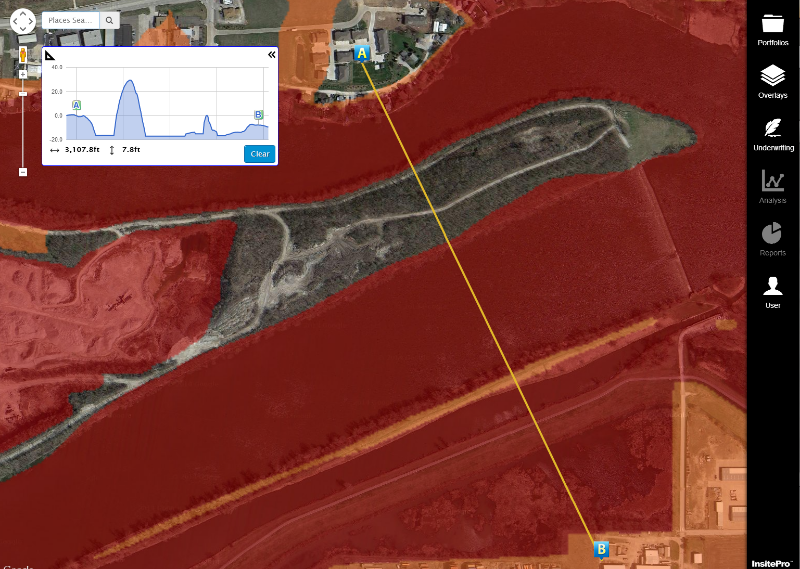

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.- The picture may not be quite as clear as the “high resolution” data provided indicates.

- The complexity of all the factors involved can lead to errors in estimation, making the computations imprecise and sometimes outright faulty.

- If the data is off on just a small percentage of risks, the impact on portfolio profitability can be quite large.

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.

Without understanding the limitations of “superior analytics,” insurance companies can be putting their bottom line in great danger.