At the Risks of Hazard we explore what is happening in the cat underwriting market. Today we can share a bit of good news close to home – our InsitePro team are now working with Chubb Global Markets. It is exciting for us here because this is a group that is leading the entry of “private flood insurance” (i.e. actual flood insurance from the insurance industry) into the US.

Topics: Floods, Flood Insurance, Flood Risk, Private Flood

While it might seem pretty obvious to most readers that good underwriting is an important part of a healthy insurance industry, it has not always been. When interest rates were high in the past decades, underwriting was the scoop with which insurers piled as much premium as possible into their coffers. With rates of return on capital at historic lows, for a long time now, underwriting is no longer a scoop – it needs to be a finely honed source of profit.

In a recent article on AM Best, Pat Gallagher – chairman and president of the eponymous brokerage giant, made this point. Here is the relevant bit:

For more than five years he (Mr. Gallagher) said he’s warned about the lack of investment income, and thinks the renewed emphasis on underwriting helps carriers and customers.

“From 1986 to 2001 we saw a ton of insurance companies go broke,” said Gallagher, as pricing “went down and down, and then after 9/11 everyone went up 100%. That’s not a good thing.”

At first, I thought it was an odd thing to say, and even more odd to publish. It seemed a bit like reading: people eating is good for the restaurant industry. But, I filed it in my ideas folder and kept coming back to it…why?

Topics: Floods, Flood Insurance, Insurance Underwriting, Flood Risk, Effective Underwriting

What Cat Underwriters Need to Know from 2015, for 2016.

Posted by Ivan Maddox on Jun 29, 2016 7:12:00 AM

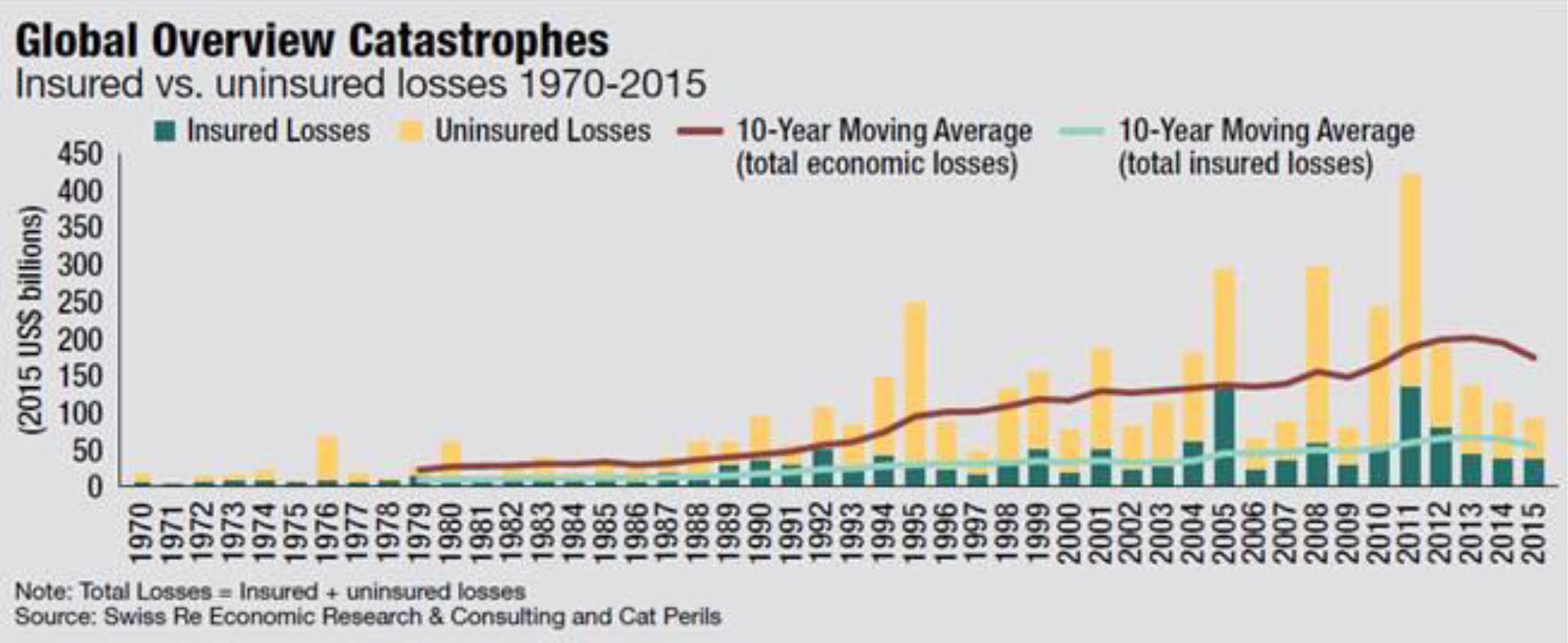

AM Best has published their annual look at World Catastrophes for 2015 (mind the subscription wall). The main three overall takeaways from 2015 are:

- The largest cat loss of the year was man-made. The explosion in Tanjian, China, caused more insured losses than any natural catastrophe last year, and was the third costliest man-made disaster for insurers in history.

- Overall, it was another quiet year for cat losses. See Graphic 1 for an historical look.

- The Protection Gap was huge enormous gigantic, especially in Asia. See Graphic 2 for the gap between total and insured losses. Light green = Gap.

Topics: Floods, Natural Catastrophe, Wildfire, Hail, Insurance Protection Gap

This week I attended the PCI National Flood Conference in Washington, DC (in Arlington, VA for geographic sticklers like me). Over the weekend, as everyone converged on the city, the sun was shining and the Potomac was sparkling as it flowed gently between its protected banks into Chesapeake Bay. It was a welcoming setting, especially for the delegation coming over from London – a significant number of underwriters and brokers from Lloyd’s.

With the published agenda occupied by 90 percent NFIP material meant to cover assorted minutiae of the program, what might these underwriters be doing there? Private flood is what they were doing there. The remaining 10 percent of the agenda addressed private flood topics, but it was the corridor talk that was predominantly about private flood.

Topics: Floods, Insurance Software, Private Flood

Last week on AMBest TV there was an interview with Hemant Shah, the articulate co-founder and CEO of cat-model makers RMS. It was a standard set of questions one would ask a cat modeler, but there was one response that’s worth a deeper look.

Topics: Floods, Insurance Underwriting, Natural Catastrophe, Other Risk Models, Earthquake