As the analysis of insurer’s first half results come in, there are a few consistent refrains. In fact, they sound like broken records.

Topics: Insurance Underwriting, Private Flood, Insurance Protection Gap

The Risks of Hazard takes a great interest in the protection gap because it is both an opportunity for underwriters and a shortcoming of insurance as an industry. Last week, Insurance Journal published a very informative look at the U.S. residential protection gap from a novel perspective: the policy holder’s perspective.

The insurance aspects of the protection gap are well documented, including how to write in the flood protection gap, what it looks like, and how it compares to emerging risks. But it is surprisingly rare to read about what that means to the policy holders. Happily, the Big I and Trusted Choice did some homework, and the results are stark.

Topics: Insurance Underwriting, Insurance Software, Insurance Protection Gap

AM Best and Target Markets (the Program Administrators Association) just put on their annual webinar exploring the state of program business.

Quickly, here is a primer on what “programs” are. Programs are when a carrier delegates underwriting of a well-defined type of coverage with very specific underwriting guidelines to independent underwriting groups typically known as Managing General Agents (MGAs) or Managing General Underwriters (MGUs). The carrier carries the risk, while the underwriting groups are the distribution network for the carrier. Lloyd’s of London does most of their US business through programs, but other big carriers (AIG, QBE, Zurich are a few that come to mind) have a wide offering of programs. A well designed program is a classic win-win, with the carrier collecting premium without the cost of sales and marketing the insurance products, and underwriters can sell coverages without bearing the risk.

Programs are interesting because they are the crucible in which many coverages are initiated and tested before becoming more broadly offered. The underwriters who bring programs to the market are known for their innovation and the field is full of start-ups. Most programs are built around non-admitted risks that require deep specialized knowledge to underwrite. Flood is a peril that fits well into a program.

Topics: InsitePro, Insurance Underwriting, Insurance Software

How to Overcome Cat and Investment Losses - Good Underwriting

Posted by Ivan Maddox on Aug 10, 2016 7:00:00 AM

Insurers are posting results for the second quarter now, and cat losses are making headlines. There were certainly a lot of claims, with Q2 driving the highest cat losses seen since Sandy in 2012. The One Brief (from Aon) published an excellent synopsis of the losses here and it makes bleak reading.

On the same day as the Aon article, Travelers published their results. Sure enough, they shared some discouraging news:

- Catastrophe losses of $333 million, up from $221 million for the same period last year, driven by wildfires at Fort McMurray in Canada and hail storms in Texas.

- Net and operating income of $664 million and $649 million, respectively, declined from the prior year quarter, primarily due to the higher catastrophe losses, higher non-catastrophe weather-related losses and lower net investment income.

- It was the smallest quarterly profit since 2012 after superstorm Sandy.

Topics: Insurance Underwriting, Natural Catastrophe, Insurance Protection Gap, Effective Underwriting

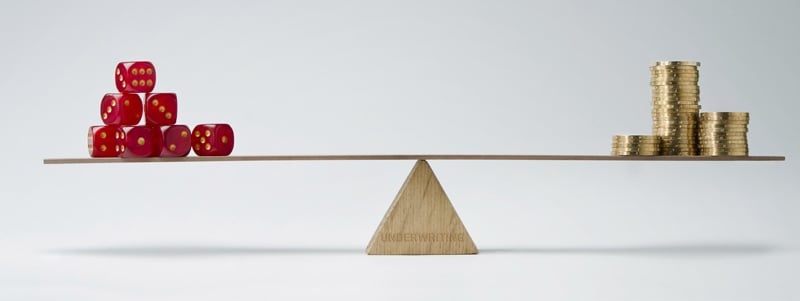

While it might seem pretty obvious to most readers that good underwriting is an important part of a healthy insurance industry, it has not always been. When interest rates were high in the past decades, underwriting was the scoop with which insurers piled as much premium as possible into their coffers. With rates of return on capital at historic lows, for a long time now, underwriting is no longer a scoop – it needs to be a finely honed source of profit.

In a recent article on AM Best, Pat Gallagher – chairman and president of the eponymous brokerage giant, made this point. Here is the relevant bit:

For more than five years he (Mr. Gallagher) said he’s warned about the lack of investment income, and thinks the renewed emphasis on underwriting helps carriers and customers.

“From 1986 to 2001 we saw a ton of insurance companies go broke,” said Gallagher, as pricing “went down and down, and then after 9/11 everyone went up 100%. That’s not a good thing.”

At first, I thought it was an odd thing to say, and even more odd to publish. It seemed a bit like reading: people eating is good for the restaurant industry. But, I filed it in my ideas folder and kept coming back to it…why?

Topics: Floods, Flood Insurance, Insurance Underwriting, Flood Risk, Effective Underwriting