Last week, the Center for Insurance Policy and Research (the research arm of NAIC) ran a panel discussion on Flood Risk and Insurance in Denver at the NAIC spring meeting. The panel discussion was in tandem with the release of their new study, Flood Risk and Insurance. Both the panel and the study were celebrated as successes in the room – and I’m not saying that just because I was an author of the study. The panel discussion featured a few real highlights for me:

Topics: Floods, Flood Insurance, Private Flood

New York has a new museum, or at least a new location for an institution. In 2016 the Whitney Museum of American Art moved down to the waterfront at the southern end of the High Line, with the new building (designed by Renzo Piano) widely lauded as a success. While most reviews and articles on the new Whitney focus on the architectural highlights and nuances, such as the design’s openness creating a seamless integration with the vibrant surrounding streets, the Atlantic published an article on its flood defenses. To wit: … the new Whitney’s most intriguing feature might be one that’s gone largely unnoticed: its custom flood-mitigation system, which was designed halfway through the museum’s construction, in the aftermath of 2012’s Hurricane Sandy, when more than five million gallons of water flooded the site.

Topics: Flood Risk, Private Flood, Flood News

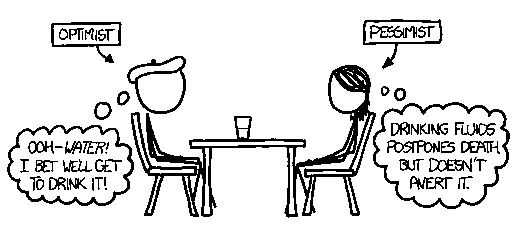

Flood Insurers 2017: Glass half empty or half full?

Posted by Bill Raymor on Dec 14, 2016 9:26:56 AM

I get to work with some very talented folks at Intermap Technologies on a Natural Catastrophe Risk product called InsitePro. It is a tool designed for underwriters that analyzes and scores location-based risk. With H.R.2901 - Flood Insurance Market Parity and Modernization Act - making its way through Congress, thus enabling the Private Flood Insurance Market to close the Insurance Protection Gap as well as alleviate some of the NFIP’s $25B debt load, we are seeing a growing interest in InsitePro. One reason for that interest is our U.S. flood model called FloodScope. It is derived from a seamless proprietary 5m elevation dataset and is both distinctly different from and more useful than FEMA’s FIRMs for evaluating flood risk at a single location. Here is the difference…

The problems facing private insurers are both many and well documented.

In a BenefitsPro article titled Insurers still coming up short on digitalization written by Jack Craver in November of this year, he stated, “One of the most common barriers to truly transforming the business via digital solutions is the persistence of legacy systems that employees continue to rely on instead of newer approaches. In fact, 80 percent say that while the organization is currently undergoing upgrades to their system, the implementation is hampered by fragmented leadership that conflicts about replacing legacy systems for policy administration and agency management.” And, in a PropertyCasualty360 article from the same month titled Top 7 Insurance industry concerns for 2017, author Jamie Yoder states his first two concerns as:

- The rise of insurance technology

There are several business challenges that established insurers are facing as they try to meet new customer needs while improving core insurance functions. A specific focus on insurance technology, or “InsurTech,” has emerged to help insurers solve these challenges. - Artificial intelligence

The initial impact of artificial intelligence (AI) primarily relates to improving efficiencies and automating existing customer-facing, underwriting and claims processes. Over time, its impact will be more profound; it will identify, assess and underwrite emerging risks and identify new revenue sources…

Topics: Flood Insurance, Private Flood, Flood News

A new kid is on the block underwriting private flood insurance in Florida today! Neptune Flood Insurance is an MGA combining a wealth of experience and some unique innovations to bring more options for property owners. Plus, it’s a great name for an MGA.

Topics: Flood Insurance, Private Flood, Flood News, Insurance News

Did anyone reading the Intelligent Insurer last week notice their Most Read highlights? Here it is from November 15:

I don’t know if it was intentional or not, but they made a perfect microcosm of an interesting and important debate resounding through the corridors of insurance conventions.

Both articles are behind the subscription wall (to which I don’t have a key), but the blurbs illustrate the point brilliantly.

The first article is from an interview with Arno Junke, CEO of Deutsche Rück, and he cautions against becoming “obsessed with developing new products driven by technology and fears of competition from new entrants.”

Meanwhile in the second article, Florence Tondu-Melique - European COO of Hiscox, cautions that “digitally-focused new players in the insurance industry are increasingly threatening the market dominance of traditional insurers in a dynamic that could ultimately force the incumbent players to become nothing more than risk carriers.”

Topics: Floods, Flood Insurance, Flood Modeling, Flood Risk, Private Flood, Insurance Protection Gap