Flaws and All

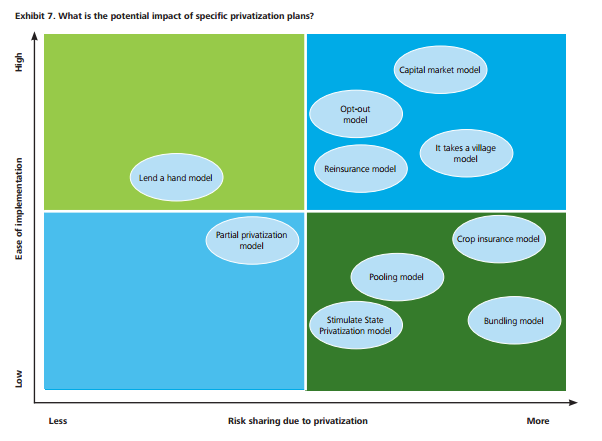

In 2014 Deloitte published a research paper entitled The potential for flood insurance privatization in the U.S. Could carriers keep their heads above water? Despite the marks the authors might have lost in the “Title Brevity” category, they more than redeemed themselves in the all-important “Usefulness” category. This is a white paper that anyone underwriting, contemplating, competing with, or studying private flood should read, over and over. It is such a rich vein of material that The Risks of Hazard is going to write two posts on it this week. Today, we will provide an overview that includes a deeper look at the key problem and solution. Later this week, we will review their survey of all the available ways that private flood can be introduced into the US market.

The title of the introductory section reveals the conclusion: Greater privatization may provide growth opportunities, but leveraging them might be problematic. It is a very safe, uncontroversial conclusion, which makes sense because it was written 2 years before the current private flood legislation is on its way to becoming law. The first half dozen pages of the report offer an orthodox summary and summation of the NFIP, its travails and its successes (yes, it has been a success for some – especially lenders).

Then it gets more interesting.