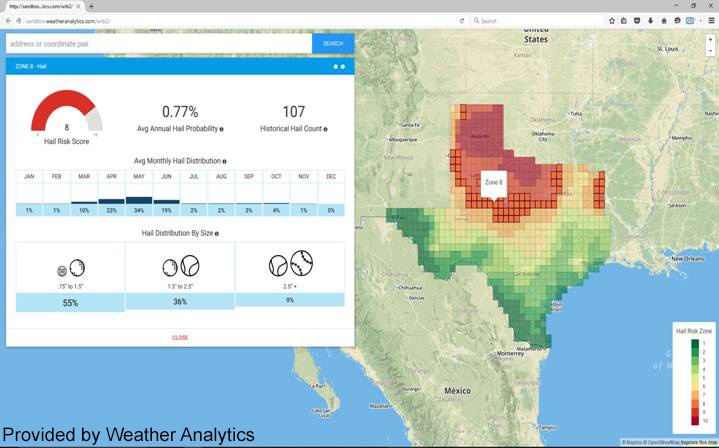

Last week, Cyrena Arnold, the Director of Product Sciences at Weather Analytics, and I blogged about hail, exploring available analytics with the March storm in the Fort Worth area. The response has been incredible to that blog, so a reprise is in order. Revisiting the topic seven days later might seem like a stretch, but there is plenty to discuss from those seven days.

Texas had a really bad March, with the big carriers posting results impacted by the March storms: Allstate, Travelers, and Progressive led the way. Then, April happened, including the April 12th storm in San Antonio that is shaping up as the costliest in Texas history – expecting over $1.3B in insured losses.