With wildfire season officially here, the Risks of Hazard is republishing the below post from last year. The question we asked in October remains valid – why do insures not do more with wildfire analytics when it’s one of the most robustly modeled cat perils?

Wildfire has been big news in 2015. The USA and Canada are both having epic years, as long-term droughts combine with hotter and drier-than-normal temperatures in much of the West burning more acres and buildings than ever. Yet, when I talk to carriers about risk analytics, wildfire seems like an ignored peril. Why?

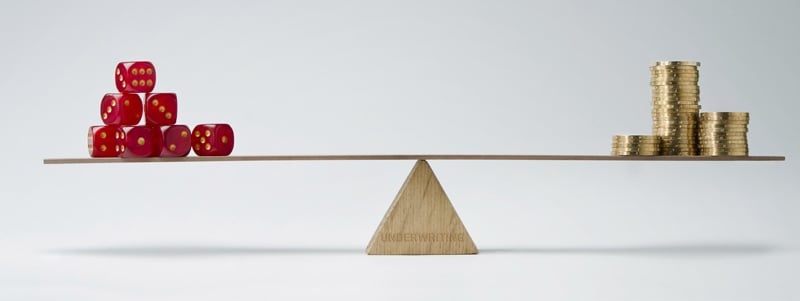

Historically, wildfire has been underwritten (or excluded) based on proximity to trees. Historically, that was adequate, too. But over the past 20 years, as towns and suburbs have expanded into wildland, the exposure to losses has increased exponentially. This week, AM Best (mind the subscription-wall) is reporting on Guy Carpenter’s estimated losses for the Western US in 2015 and the figures are eye-catching: $1.75 billion.