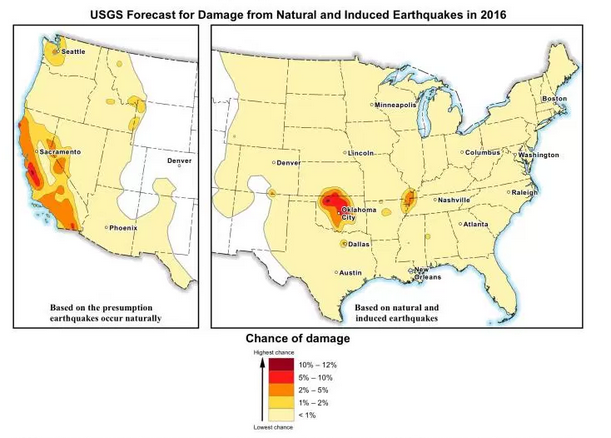

It is not often a new cat peril appears, but Oklahoma is now an earthquake zone. The changing seismicity in the state is so pronounced that the USGS is committing to updating their earthquake hazard maps annually, instead of every five years. The high risk blotch on the USGS maps dwarf the better-known (but still relatively obscure) New Madrid zone in southeast Missouri and the Cascadia zone in Washington. Note: these are “chance of damage” maps, and do not express severity.

The arrival of a localized cat peril has provided a unique glimpse into how insurers and regulators work together to ensure the risk to property is adequately mitigated. According to AM Best (May 25, mind the subscription wall) the Oklahoma Insurance Commissioner, Mr. John Doak, is making a determination right now on whether the insurance market for quake coverage is competitive enough to avoid further state regulation. His decision will determine whether state regulators will have more or less influence on insurance pricing and terms. Specifically, according to the AM Best article: “Doak is concerned recent filings do not substantiate the need for increased rates, that the use of multi-line discounts discourages consumers to switch carriers for a lower price and that 70% of earthquake policies are sold by just a few companies (Best’s News Service, April 19, 2016).”