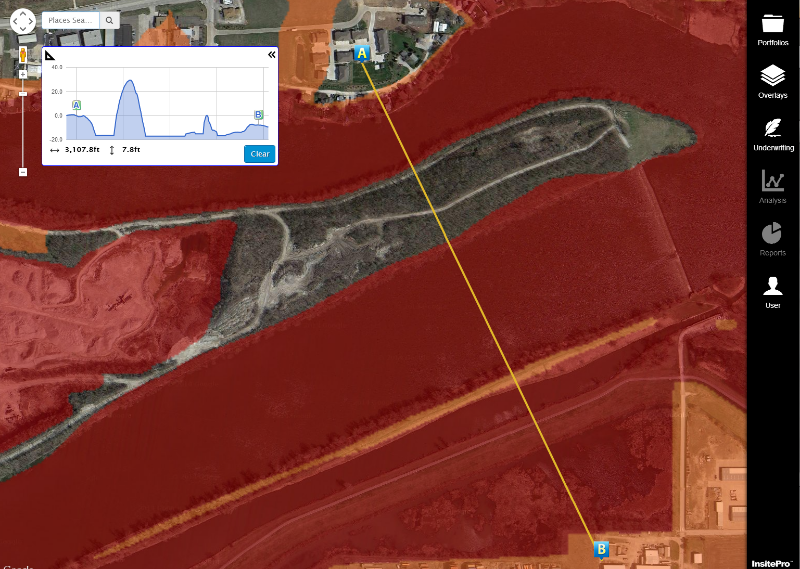

Last week, I had the pleasure of meeting representatives from three Lloyd’s syndicates for the first time. It was an exciting time for me and my product (InsitePro™), because Lloyd’s is always a milestone for any new product serving insurance. The real beauty of the meetings, though, was that they were not in the City of London, but rather, in a small American prairie city.

The Lloyd’s market is an icon of insurance, with its vast history, its innovative approach to risk management, and its global reach. To many people, Lloyd’s of London IS insurance. I always thought, though, that my first meetings with a Lloyd’s syndicate would be in London at their famous headquarters. Nope.