This blog post is part 2 of 2 exploring how underwriting leakage manifests itself in the property insurance market. On Tuesday it was rate fluctuations after a catastrophic event. Today, we look at the coverage gap.

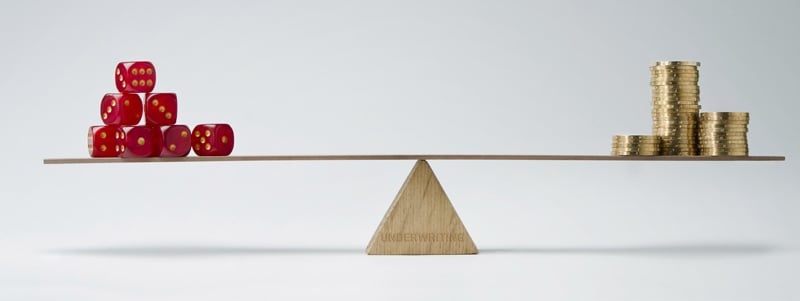

To recap briefly, underwriting leakage is the difference between perfection and reality when an underwriter assigns financial conditions on risk. Ideally, there is no difference, but in reality there is always a difference.

The coverage gap is the difference between total economic losses from an event and insured losses. It can be caused by a lack of insurance penetration into a market, a lack of suitable products available, or certain coverages missing from the available products. Here is a recent paper on the coverage gap from Swiss Re (they call it the “protection gap”, but it’s the same thing) that explains it much better. In a perfect world there would be no coverage gap because all the necessary policies would be available at the right price, offering the right coverage. This is the perfect world where there is no underwriting leakage.