New York has a new museum, or at least a new location for an institution. In 2016 the Whitney Museum of American Art moved down to the waterfront at the southern end of the High Line, with the new building (designed by Renzo Piano) widely lauded as a success. While most reviews and articles on the new Whitney focus on the architectural highlights and nuances, such as the design’s openness creating a seamless integration with the vibrant surrounding streets, the Atlantic published an article on its flood defenses. To wit: … the new Whitney’s most intriguing feature might be one that’s gone largely unnoticed: its custom flood-mitigation system, which was designed halfway through the museum’s construction, in the aftermath of 2012’s Hurricane Sandy, when more than five million gallons of water flooded the site.

Topics: Flood Risk, Private Flood, Flood News

One way to start the new year is to take a look back and see how the previous year looks now that it’s in the past (which means we’re in the future now, which is neat).

Topics: Flood Insurance, Insurance Software, Insurance Technology, Insurance Protection Gap

The Risks of Hazard would like to copy most other blogs and news outlets by concluding the year with a “Best of” edition. Below are the 10 blog posts that not only had the highest readerships, but had the most comments, caused the biggest stir, and resounded most with thought leaders.

Without any ado whatsoever (except this intro), here is the Risks of Hazard Top 10 for 2016:

10. How to Underwrite “Challenging” Flood was a post we wrote based on a Lloyd’s of London/JBA report on the flood risk in California’s Central Valley. We described how underwriters could successfully underwrite flood in the region, which was clearly something many readers wanted to know.

9. Problem: Underwriting with Accumulation Software made a statement that has since resonated loudly with many of the underwriters we talk to: they’ve been asked (for years) to underwrite with software not built for underwriting. It has been quite a realization.

Flood Insurers 2017: Glass half empty or half full?

Posted by Bill Raymor on Dec 14, 2016 9:26:56 AM

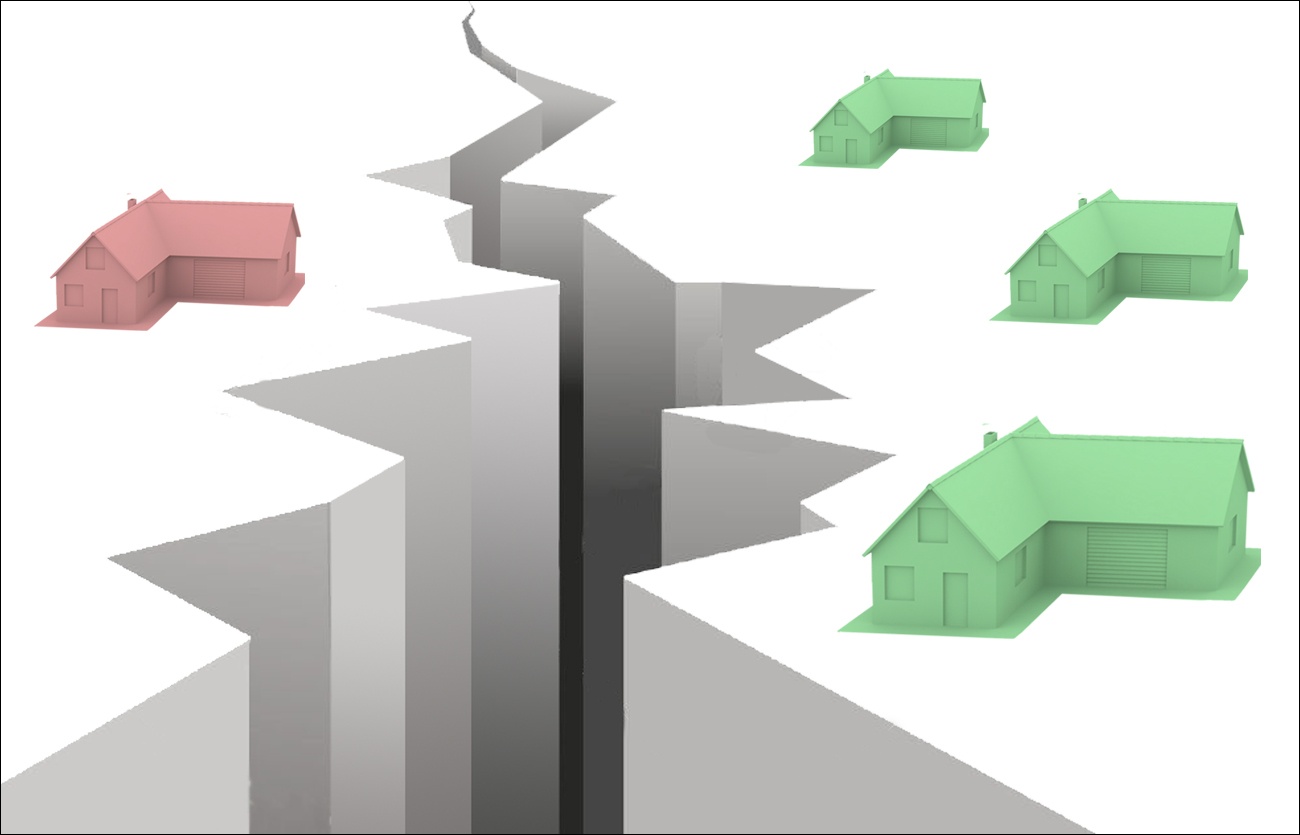

I get to work with some very talented folks at Intermap Technologies on a Natural Catastrophe Risk product called InsitePro. It is a tool designed for underwriters that analyzes and scores location-based risk. With H.R.2901 - Flood Insurance Market Parity and Modernization Act - making its way through Congress, thus enabling the Private Flood Insurance Market to close the Insurance Protection Gap as well as alleviate some of the NFIP’s $25B debt load, we are seeing a growing interest in InsitePro. One reason for that interest is our U.S. flood model called FloodScope. It is derived from a seamless proprietary 5m elevation dataset and is both distinctly different from and more useful than FEMA’s FIRMs for evaluating flood risk at a single location. Here is the difference…

The problems facing private insurers are both many and well documented.

In a BenefitsPro article titled Insurers still coming up short on digitalization written by Jack Craver in November of this year, he stated, “One of the most common barriers to truly transforming the business via digital solutions is the persistence of legacy systems that employees continue to rely on instead of newer approaches. In fact, 80 percent say that while the organization is currently undergoing upgrades to their system, the implementation is hampered by fragmented leadership that conflicts about replacing legacy systems for policy administration and agency management.” And, in a PropertyCasualty360 article from the same month titled Top 7 Insurance industry concerns for 2017, author Jamie Yoder states his first two concerns as:

- The rise of insurance technology

There are several business challenges that established insurers are facing as they try to meet new customer needs while improving core insurance functions. A specific focus on insurance technology, or “InsurTech,” has emerged to help insurers solve these challenges. - Artificial intelligence

The initial impact of artificial intelligence (AI) primarily relates to improving efficiencies and automating existing customer-facing, underwriting and claims processes. Over time, its impact will be more profound; it will identify, assess and underwrite emerging risks and identify new revenue sources…

Topics: Flood Insurance, Private Flood, Flood News

Last Wednesday Fitch released their report on 2017 P&C Underwriting, and it was a pessimistic appraisal. Soft pricing, increased competition, increasing cat losses - sounds bad, doesn’t it?

Topics: Insurance Underwriting, Insurance Software, Insurance Protection Gap