This is a joint post by Ivan Maddox and Cyrena Arnold, Director of Product Sciences at Weather Analytics.

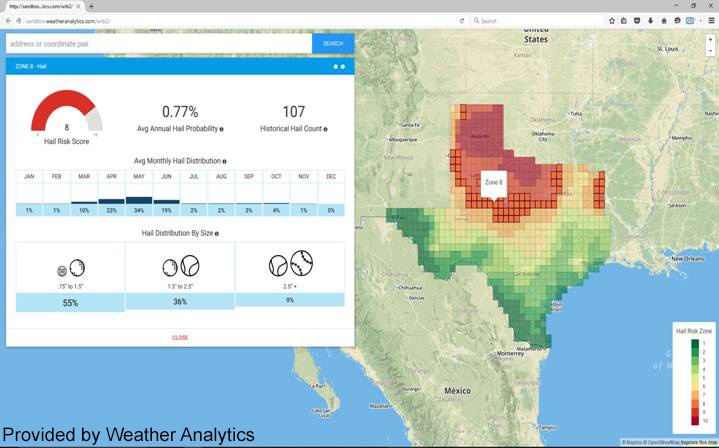

Hail. For property underwriters, hail is the peril that probably frightens them most. It is rarely excluded from homeowner policies, it is highly damaging, and very common in certain areas. Hail caused $6.6B in claims in the US in 2014 (AM Best), and there are hardly any decent underwriting tools to help out with it. In case a reminder was needed, here is AM Best’s coverage of Progressive’s Q1 results:

Net income dropped 13% at Progressive Corp. in the first quarter as catastrophe losses increased to $102 million, compared with $9 million a year earlier. Eighty percent of those losses came in March, when wind and hailstorms pummeled Texas and Louisiana.

Two hailstorms in the Dallas-Fort Worth metroplex caused insured losses industrywide of about $1.3 billion. A third storm in the region on April 11, with reports of softball-size hail and strong winds, may have been even more damaging (Best’s News Service, April 12, 2016).