Wow, 2016 is now half over. It has been an eventful half year, including private flood legislation coming closer to implementation and historic wildfires in Alberta and California.

Topics: Flood Insurance, Insurance Underwriting, Flood Modeling, Flood Risk, Effective Underwriting

Two weeks ago, we published a post on how analytics aren’t so smart after all. It has been a sensation (only our Cat Modeler’s Guide to the Protection Gap has been read more this year), so it is only natural that we pursue the topic further.

The blog that lit up a little corner of the web was about the limitations of analytics, specifically flood risk analytics. It turns out there is some interesting science and folklore about the topic, so let’s take a look.

Analytics are an attempt to measure an immeasurable phenomenon. Cat risk analytics (flood, quake, hail, etc.) are perfect examples, as they aspire to determine the chance of something happening in a given location during a given timeframe – it is not possible. However, by evaluating a combination of different types of information, they can begin to produce results that are useful for underwriters who need those unknowable answers.

Topics: Flood Risk, Effective Underwriting, Analytics

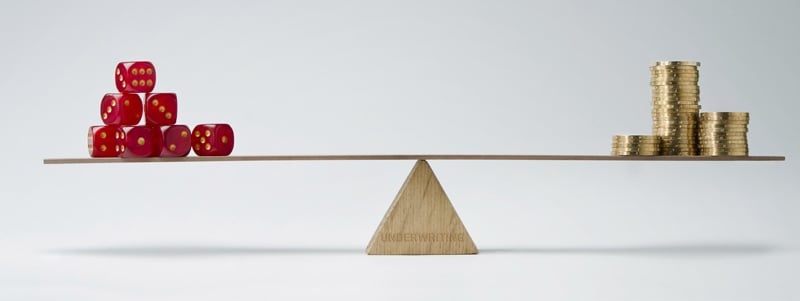

Is crucial underwriting profit going down the drain?

Posted by Ivan Maddox on Mar 29, 2016 7:00:00 AM

There is a lot of buzz in industry literature about how underwriting profit is increasingly an essential profit source, with investment returns on capital so low.

Topics: Risk Scoring, Insurance Protection Gap, Underwriting Profit, Effective Underwriting

There are two distinct analyses needed to underwrite property: risk assessment and accumulation. The first is the evaluation of a risk based on information specific to the risk, so that it can be accepted and rated, or rejected. The second limits the writing of new risks within a defined geographical area to prevent excessive losses from a single event. Both are important for underwriting cat risks: assessment because of the potential of losses up to the full value of a property (and beyond), and accumulation because cat events cause damage to swaths of properties at once.

For many cat perils, though, much of the data used to assess the risk is not specific enough – it is generalized and inadequate for underwriting. Underwriters that use generalized data for risk assessment and depend upon their accumulation to manage their portfolio are goldfish underwriters; they keep writing risks until they fill up their aggregation limits, like goldfish keep eating until they fill up their bowl.

Topics: Risk Management, Natural Catastrophe, Underwriting Profit, Effective Underwriting

One of the best talks I’ve heard on insurance innovation is The Changing Landscape of Risk presented by Robert Schimek of AIG (SVP and CEO of Americas Region). He was speaking at MarketScout’s Entrepreneurial Insurance Symposium in Dallas in December.

The fact that only the people in the room, plus 63 people on YouTube, have heard it is a shame. It is super informative, very entertaining (on the Insurance Technology Lecture scale), and (for me) it accomplished the elusive goals of a good talk: it asked questions that changed the way the audience thought of problems, and provided answers to questions the audience didn’t know they had. As a bonus for blog writers, it is a gold mine of material – I will be visiting Mr. Schimek’s material over and over.

The overall subject of the presentation was the importance of entrepreneurial innovation in insurance. He had to lay a little groundwork, because AIG’s view of innovation is likely to be different from pretty much the rest of the industry’s; i.e. 63,000 employees and they pay ~ $110M in claims every day…not quite your typical insurance company. Because of this, he is also able to bring some interesting holistic macro viewpoints to the conversation.

Topics: Insurance Underwriting, Insurance Technology, Innovation in Insurance, Effective Underwriting